Here we go again

Donald Trump was elected President of the United States for a second time on the fifth of November last year, although it seems like years ago now. Shortly after, we wrote about what it would mean for sustainable investors; you can read that here. We also talked about the implications in our fourth quarter 2024 webinar update, shortly after his inauguration. This slide from that presentation summarised our thoughts then:

It’s unusual for us to be revisiting the topic two months later, in this quarterly review. We tend to think in much longer cycles, and our investment horizon is best measured in years rather than weeks. But we are back on “Trump time”, where events seem to fly by at unnatural speed. Moreover, this new administration has really hit the ground running, and moved further and faster than pretty much anyone truly expected.

So we’ll try to recap some of the key highlights and lowlights here, and what they mean for sustainability, and our strategy.

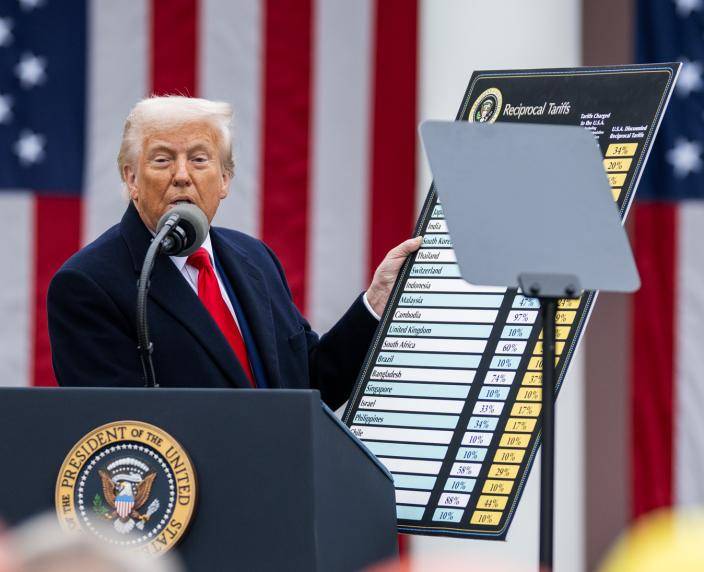

The “Tariff Man”

The first topic we called out in our webinar was trade, and even in a crowded field, that might be the single noisiest policy area of the new era. On 2 April Trump confirmed the rates of tariffs on imports from all the key trading partners of the US. In the first Trump presidency there was lots of bluster about tariffs but the resulting levies were actually small and changed little. This time around it is a different story, with tariffs over 10% broadly all imports – and more in fact, for partners deemed “bad actors”.

President Donald Trumps unveils the new tariff regime, 2 April 2025

Source: The White House, Public domain, via Wikimedia Commons

Trade disruption is a challenge for sustainability because much of it is achieved with globalised products. A large majority of our strategy, and the universe of companies we select from, have revenues split somewhat equally between the Americas, Europe and Asia.

However, our companies have learned from the first Trump term, and the Covid experience. Supply chains have moved and been duplicated, and customer relationships have been recast. Many of our companies, for example Siemens Healthineers (in the Health theme), and MSA Safety (in the Safety theme) operate a “twin factory setup” which allow them to service clients from their own regions.

Moreover, most of our companies’ products are highly differentiated. That gives them pricing power to pass those tariffs on to customers. Keyence, a machine vision company in our Resource Efficiency theme, might be the best example of that – it has operating margins over 50%. Tariffs will make things harder, but in the long term we’re confident that market shares will broadly be maintained, and that our quality companies will ride this out.

Inflation risk

There is another side to the tariff chaos though, and that is inflation. At least in the short term, we look set for an unwelcome boost to inflation around the world. Expectations for inflation have already started to rise, and there is a painful circularity to that, as sellers start to raise prices in anticipation. This in turn leads to interest rate rises, which in turn puts downward pressure on equity valuations.

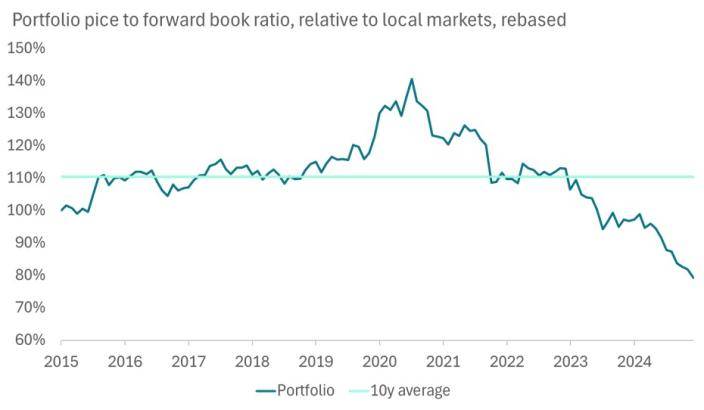

In 2016 and 2022 the strategy really suffered from rising interest rates. But both times valuations in sustainability stocks were full – very full, in the latter case. This time is different. Our portfolio features a number of companies where valuations are at the lowest level for over a decade.

Sustainability in the crosshairs

The second topic we saw in the crosshairs at the inauguration was wind energy. This was ruthlessly cut down with an executive order shortly afterwards. A moratorium on all federal permitting for offshore, and onshore wind projects leaves that important industry in a state of limbo. The strategy has a small exposure to market-leading turbine-maker Vestas. We’re happy to hold it because its share price already prices in no further growth in the US, for the foreseeable future. For the rest of the world, wind is still very much part of the power mix.

Third on the list was action against electric vehicles. This is still potentially coming, but will need Congress’s support to withdraw the key subsidies. In the meantime, the imposition of tariffs is likely to have a more profound impact on the rate of electric vehicle adoption. But the message here is slightly confused. One of the striking images of these early days, is the President himself buying an electric vehicle at the White House.

Source: The White House, Flickr

Our exposure to electric vehicles is spread across the portfolio. We have direct exposure through companies in our Sustainable Transport theme, including Infineon, Aptiv and TE Connectivity. We have indirect exposure too, for instance through Keyence in the Resource Efficiency theme. As much as their short-term prospects are uncertain, what is now evident about electric vehicles is that they are, broadly speaking, better than internal combustion vehicles, for about the same price. In the long term, it is clear what that means.

The fourth area of concern we laid out in January was healthcare. Robert F. Kennedy Junior, a noted vaccine sceptic with some interesting views on science, has now been appointed Secretary of Health and Human Services. Along with wholesale staff changes at the 13 operating divisions he oversees, there is an ideological shift taking place. This impacts the way scientific research is funded and rewarded, as well as how healthcare is provided.

With 27% of the strategy (and 40% of the universe) in the Health and Wellbeing themes, this could be significant. But given the complexity of the industry, and the importance of its outcomes, the scope for change is more limited than the new administration would admit. And the drive to discover new life-improving therapies is hard to stop. Our exposure to healthcare research, through companies such as Thermo Fisher, Lonza, and Astra Zeneca, remains a secure long-term bet, in our view.

The last of the changes we saw as significant was the introduction of the Department of Government Efficiency, or DOGE. Without any precedent for this kind of body or initiative, or how the influence of its leader Elon Musk would actually manifest itself, it was a little hard to see what this would mean. Two months later, we have a clearer view. Sweeping cuts right across government have been accompanied by more ideologically-driven changes to government leadership.

As well as creating headroom for tax cuts, the intention seems to be to meaningfully reduce the role government plays in a number of areas. By design, these include many of the most impactful areas, such as overseas aid, environmental regulation, and education. With a nearly two-decade track record, we are very familiar with the risks of over-reliance on regulation. Our holdings in these areas, such as consulting engineer Arcadis, and tertiary education provider Grand Canyon Education, have been selected for their comparatively low regulatory risk.

The confidence game

The above are just the areas of greatest immediate direct concern to impact investors. But there is more to this still. At the highest level, solving sustainability challenges requires investment – and co-ordinated investment, from a range of stakeholders, from the companies themselves, through intermediaries such as your manager here, through to you as the ultimate asset owner.

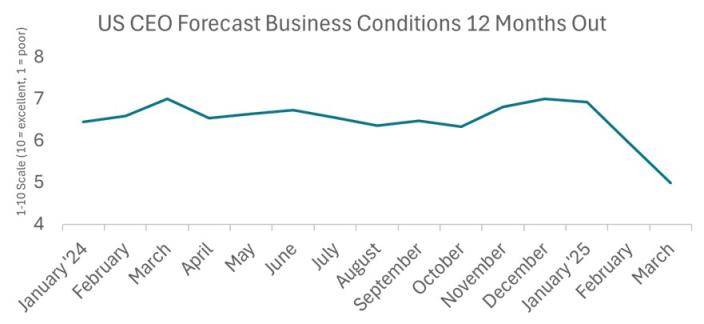

Investment in turn, requires confidence. And where we have been surprised, is in the extent to which the new administration is happy to be reckless with some key aspects of investment confidence. As outlined above, the moves on tariffs are clearly a big part of this. But the abrupt and aggressive changes to foreign policy (particularly on Ukraine, and Greenland) play their part too.

For those that are watching carefully (and a lot of CEOs and investors are in that category) then Trump’s attacks on the rule of law are very concerning. A prime example of which is his commentary on a possible third term, in obvious contradiction of the US constitution.

The upshot is that the world is now in “wait and see” mode, not just on sustainability, but on any kind of investment.

Source: ChiefExecutive.net. https://chiefexecutive.net/ceo-optimism-plummets-in-march-amid-tariff-uncertainty/

These too shall pass

We had thought that the Trump election could be a clearing event to rebuild from, even with the direct challenges to sustainability. It’s clear that, with the collapse in general investment confidence, we are going to need a little more patience.

But it will just be patience, because like everything, this too shall pass. Like any President, Trump’s peak popularity is at the start of his term, and the mandate inevitably weakens from here. In this case, we are already seeing his popularity levels falling.

On the other hand, the drive to sustainability can only be suppressed for so long. The challenges only become more intense, and impact more people. And the technology only improves and becomes more competitive. By setting himself up so clearly in opposition to impact, Trump’s policy mistakes will highlight the power of the alternative path.

In the meantime, we continue to search for the best investments for a more sustainable future, taking each development as it comes, but keeping our eyes on the long-term horizon.

Sign up here to receive our monthly and quarterly commentaries in your inbox.