What a Trump presidency means for sustainable investors

We’ve heard a lot about the ‘Trump Trade’ in the aftermath of the US election. This describes the huge stock market gains experienced by various sectors in the hours and days following the result.

It paints a bleak picture: Bitcoin, defense, and private prison firms all soared, while cleaner energy stocks sold off.

Is this really what we should expect for the next four years?

While it may seem as though the world has just become a more hostile place, we believe the future is still bright for sustainability investors.

Energy is less political than people think

The fourth item on Trump’s campaign manifesto, ‘Agenda 47’, promises to make America the dominant energy producer in the world (by far!)1.

The first thing that springs to mind when you read this statement may be ‘Drill Baby, Drill’. Trump is certainly no ally to the climate agenda. He pulled America out of the Paris Agreement during his first term as President and has promised to do it again.

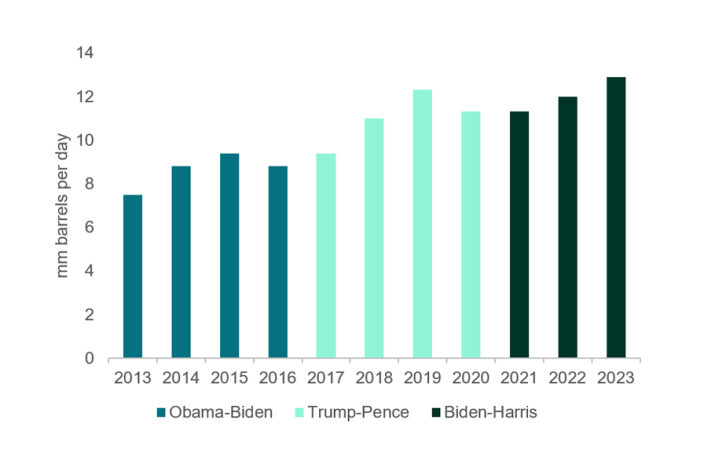

However, data show that the debate of ‘fossil fuels vs cleaner energy’ over the last three US Presidencies hasn’t been a political one at all.

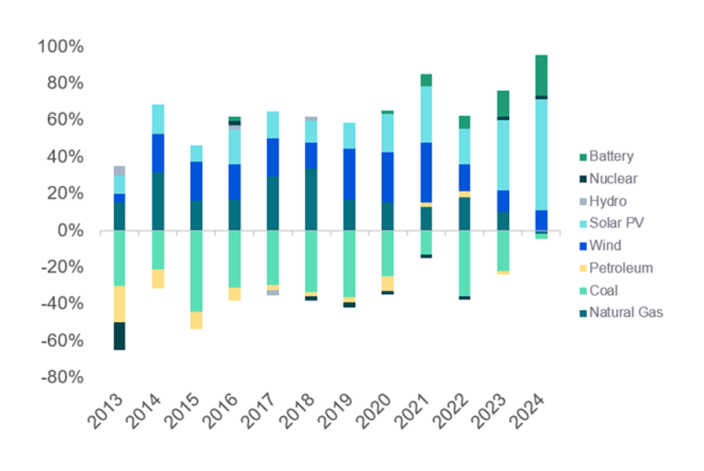

Both Republican and Democrat administrations have overseen a surge in oil production, and massive increases in solar energy capacity – as the charts below demonstrate. In fact, if anything Trump’s from 2016-2020 resulted in a massive acceleration in the deployment of solar and wind.

US crude oil production2

US Electricity Grid utility-scale capacity additions3

Market forces ‘Trump’ policy

It is true that a Harris administration would have provided a more stable and supportive policy environment for the cleaner energy sector.

However, this doesn’t mean that a Trump presidency signals doom for the climate transition. It just means that the policy environment won’t be as supportive as it might otherwise have been.

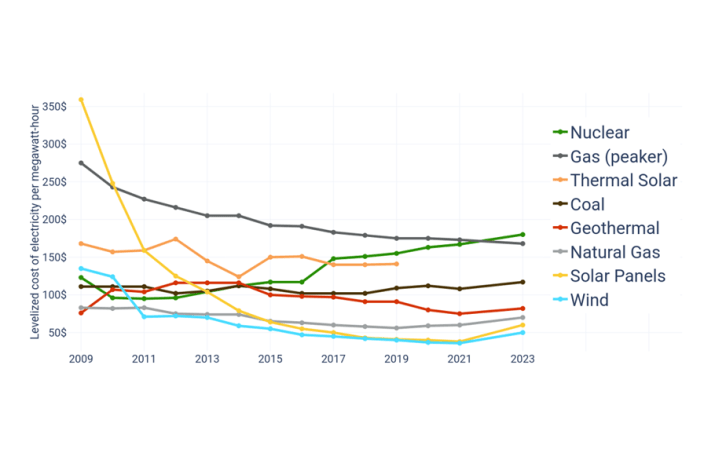

In reality, decisions about how and where to add energy capacity are made on the basis of economic factors and return on investment calculations.

And the economic reality is that onshore wind and utility scale solar are still the cheapest forms of energy you can build, as shown in the following graph.

Levelized Cost of Energy Comparison4

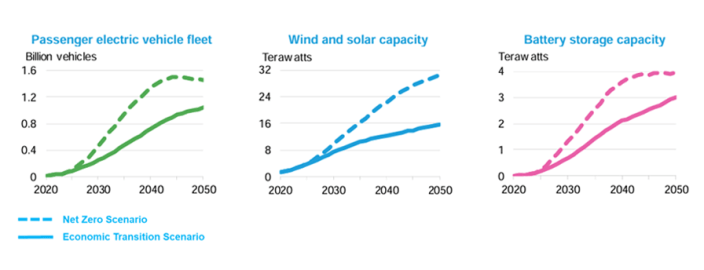

Bloomberg New Energy Finance (BNEF) recently conducted a scenario analysis which looked at the future adoption rates of clean technologies.

Their ‘Economic Transition’ scenario forecasted future penetration rates for each technology based on economic factors alone.

Their ‘Net Zero’ scenario incorporated the potential for policy support to drive penetration rates even higher.

They found that, while a supportive policy environment would accelerate the transition, it is not necessary to drive growth. Market forces alone could drive huge growth in cleaner energy technology.

Bloomberg New Energy Finance (BNEF) adoption scenarios5

What this means for our portfolio

Only around 4% of our portfolio is currently held directly in cleaner energy stocks. This is because they tend to be very volatile, and we don’t see the need to allocate a larger portion of our portfolio risk budget to these names.

However, we continue to hold another 25% of our portfolio in the ‘Resource Efficiency’ theme. This contains a basket of Industrial businesses that are seeking to improve the way we use energy and other resources. These companies tend to be highly correlated to the energy transition.

We are mindful that a Trump presidency may lead to a surge in American isolationism. For that reason, we are thinking carefully about our companies’ supply chains and geographic exposures, to minimize risks from potential tariffs.

However, we don’t anticipate making any major changes to our thematic allocations. We don’t see the need to retreat.

We believe the Trump Trade was driven by ‘meme stock’ euphoria. As the world grows accustomed to its new political context, we are confident that this euphoria will give way to economic reality.

Sign up here to receive our monthly and quarterly commentaries in your inbox.

1 https://www.donaldjtrump.com/platform

2 Source: https://theconversation.com/under-both-trump-and-biden-harris-us-oil-and-gas-production-surged-to-record-highs-despite-very-different-energy-goals-236859

3 Energy Information Administration (https://www.eia.gov/outlooks/steo/data/browser/#/v=23&f=A&s=&start=2012&end=2025&linechart=NGEPCGW_US&ctype=linechart&maptype=0&id=

4 https://www.lazard.com/research-insights/2023-levelized-cost-of-energyplus/

5 Bloomberg New Energy Finance (BNEF) New Energy Outlook 2024.