How did impact investing arise?

'Impact Investing’ as a term was first coined in 2007 by the Rockefeller Foundation, but the practice itself has a long history that pre-dates this.

The approach at the centre of impact investing took some time to develop because shareholder primacy - the view that shareholder's needs should be prioritised over those of the other stakeholders of a company - was the prevailing theory from the 1970s.

However recent decades have seen increasing support for sustainability and impact investing due to growing global awareness of the climate crisis as well as other environmental, social and ethical issues.

In 2009, the Global Impact Investing Network (GIIN) was established to ‘champion impact investing and increase its scale and effectiveness around the world’. The word “impact” itself played an important role in crystalising the movement.

Impact investing and the spectrum of capital

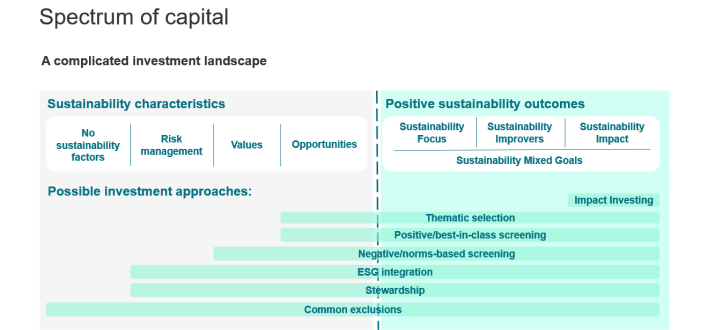

Impact investing is a specific type of sustainability investing, along with environmental, social and governance (ESG) integration, exclusionary and inclusionary investing.

Perhaps confusingly, ‘ESG investing’ has become a catch-all term covering a range of investment objectives and outcomes. In many cases, it refers to ESG integration, in which environmental, social and governance metrics or data are considered within investment analysis and decision making.

Many investors use ESG ratings from specialist data providers to assist with this process but this may not provide the whole picture when the underlying data isn't fully understood. In addition, ESG metrics typically focus on how the company operates, rather than what the company produces.

Exclusionary and inclusionary approaches (also called positive or negative screening) screen investments based on certain characteristics, and often focus on the relative performance of companies by comparing them to their peers and may rely heavily on ESG data alone.

ESG integration alone typically leads to investment portfolios that are diversified across the economy, including the ‘best’ companies from inherently controversial sectors such as armaments, tobacco and oil and gas.

That's why impact investors like WHEB, intentionally invest for positive outcomes. For us, this means investing in companies that sell products and services which provide solutions to sustainability challenges and protect or enhance quality of life.

As a result, we maintain a clear and deliberate focus on analysing what a company is selling. Companies that sell products with negative impacts - such as armaments, tobacco and oil and gas - don't qualify as impact investments for us.

Impact investors may also take account of ESG issues in their analysis of the operational activities of potential investments. In all cases, impact investors will also consider the likely financial returns available.

Impact investing is ultimately about delivering positive social or environmental impact alongside a financial return.

At WHEB, we're not interested in short-term tactical trading: we believe that our focus on impact should support competitive financial returns over the long-term.

The spectrum of capital below is created by WHEB and maps the range of sustainability investing strategies. It also includes the Financial Conduct Authority’s (FCA) new sustainability labels from their Sustainability Disclosure Requirements (SDR) regime.

Combatting 'greenwashing'

Sadly, along with a rise in interest in sustainable investing, there's also been a rise in ‘greenwashing’ in the industry.

This happens when investors portray their efforts as having greater positive sustainability outcomes than they do in reality, often for the purpose of marketing or public relations.

Ultimately, greenwashing risks undermining the movement towards sustainability investing and reducing the ability to enable positive outcomes in the real world.

The good news is that there are a range of new regulations and standards like SDR - many of which WHEB has contributed to - being developed by renowned organisations to try and combat greenwashing in sustainable investing.

This will require investment managers to be clear about their intentions, rigorous in their approach and provide transparent evidence that they've done what they say they'll do. This will be difficult for investment managers who are guilty of greenwashing, forcing them to alter their marketing or improve their practices.

Ultimately it means that the end investor can be confident that their money is being invested in the way they intended.

What makes our approach to impact investing unique?

In this section we go into a bit more detail on our approach to impact investing.

Thanks to the rise of ‘greenwashing’ and now ‘impact washing’, transparency and authenticity are more important than ever.

What's our solution? Radical transparency. Being as open and transparent as possible about our approach to impact investing.

We've set out our perspective in a white paper where we:

- Explain the different types of investment impact

- Discuss impact investing in the context of listed equities

- Make the case for WHEB’s holistic model of impact investment in listed equities. You can find an interactive version of this model below

What sits at the core of being an impact investor? Intention.

The decision to invest must be clearly based on the ‘enterprise impact’ of the business. By ‘enterprise impact’ we mean the impact delivered by the products and services the company is producing.

The impact story needs to be a significant part of the investment case and we need to intend for the investment to contribute to positive impact.

We're dedicated to investing in this way. For each of our nine investment themes we've set out a ‘problem statement’ that we're trying to solve.

We then set out a ‘theory of change’ - a sequence of cause-and-effect actions that connect WHEB's activities with the specific positive social and environmental outcomes that we are targeting. This theory of change frames all of WHEB's investment activities.

Clients and their advisers want to know that we're investing their money in a way that aligns with their values and enables positive outcomes.

We embrace this deeper client interest in our portfolio companies and we've made a commitment to radical transparency in sharing information about our philosophy, policies and practices.

When WHEB invests in portfolio companies, we make our own contribution to increasing positive outcomes - and this, in turn, impacts the share price.

But while this investment benefits portfolio companies in multiple ways, there are two additional key areas where we make a contribution as investors:

- Enterprise level: Through stewardship activities such as engagement with companies and proxy voting at AGMs.

- Systems level: Engagements aimed at the wider financial system that indirectly support positive impact businesses.

WHEB’s contribution in these areas includes engagement downstream with regulators, policy makers and standard setters, as well as upstream back to clients and their advisers.

The vast majority of WHEB’s impact comes through the investments we make.

However, as a business we also have a direct social and environmental footprint. We seek to maximise the positive impact that we have through our

own operations and report on this annually.

Impact investing glossary

We want impact investing to be accessible to everyone.

It can be challenging to keep up with the evolving terminology and acronyms in the sustainability investment world. That's why we've put together a short glossary to help you navigate through the jargon.