Reflecting on 2024: Strengthening stewardship and engagement for a sustainable future

With 2024 now behind us, we reflect on WHEB’s Stewardship and Engagement efforts - celebrating accomplishments, learning from challenges, and identifying opportunities for 2025.

This year, our stewardship activities spanned a range of impactful initiatives, including direct engagements with portfolio companies—both individually and through collaborative investor coalitions—active participation in voting at company AGMs, and policy advocacy to drive systemic change. Below we share updates on this work from the last year.

1. Climate Action

Our focus remained on encouraging portfolio companies to adopt science-based net zero carbon (NZC) targets, particularly those validated by the Science Based Targets initiative (SBTi) 1.

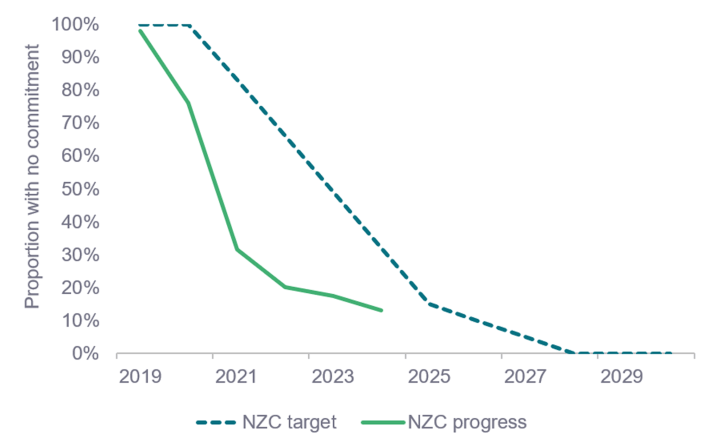

Setting such targets is a critical precursor to achieving meaningful emissions reductions. They also align with our own commitments to have 85% of financed emissions covered by NZC targets by 2025 and 100% by 20282.

As of 2024, 87%3 of the portfolio’s financed emissions are covered by NZC targets. 77% of the financed emissions are covered by SBTi-validated targets, rising to 90% when including companies that have committed to setting such targets, positioning us well to meet our commitment by the end of this year (Figure 1).

Figure 1: WHEB’s portfolio is on track to meet 2025 and 2028 commitments to proportion of financed emissions covered by NZC targets

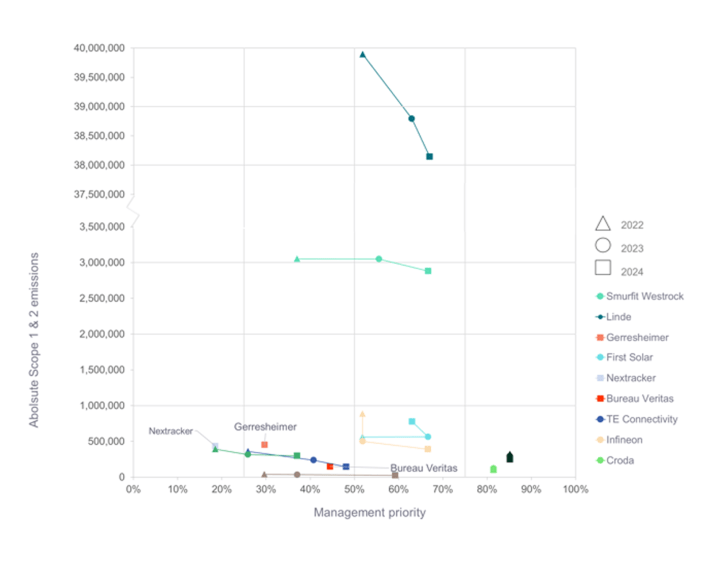

To drive meaningful reductions, we prioritise engaging the top ten emitters, responsible for 80% of the portfolio’s Scope 1 and 2 (financed) emissions.

Progress is evident for nine of these companies from 2022 to 2024 – both in terms of advancements in “management priority” (i.e. alignment of strategy with the Paris agreement) and reporting measurable reductions in absolute emissions (Figure 2).

Notably, TE Connectivity has achieved an impressive 72% reduction in scope 1 and 2 emissions since 2020, driven by significant increase in its renewable energy consumption. This includes a 45% decrease in Scope 2 emissions from FY 2022 to 20234. We commend the company for its achievement, especially as it has been a focus of our engagement efforts throughout 2023 and into 2024 via the Net Zero Engagement Initiative5.

The Scope 1 and 2 emissions of First Solar have, however, unfortunately increased over the past year. This is due to the rapid scaling of production that the company has achieved. In 2022 the company manufacturing 9GW of solar modules. In 2024 it is expected to have been over 14GW6.

Still, the company took positive steps towards reductions last year, including a commitment to power 70% of its Indian operations with its own solar panels by the end of the year 7. This news was gratifying to us along with colleagues from the Investors for Sustainable Solar initiative8, as WHEB has been encouraging the company to enhance renewable energy sourcing through its own products.

Figure 2. Absolute Scope 1 & 2 emissions are decreasing for 9 out of 10 of the WHEB Strategy’s top emitters (by financed emissions)9

2. Diversity Equity & Inclusion (DEI)

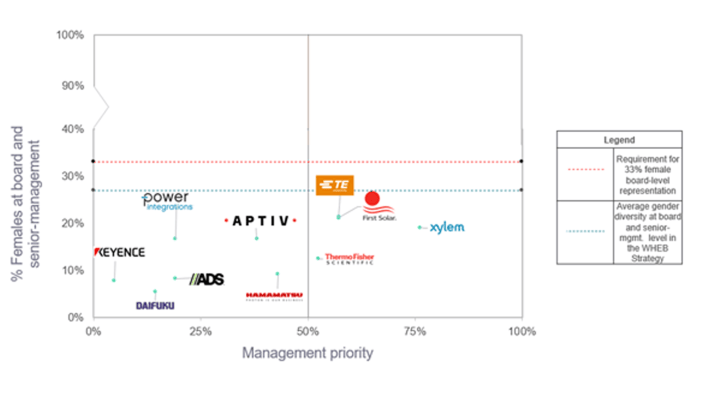

DEI is in our view a moral and a business imperative10,11. As in previous years, our approach in 2024 focused on gender and was driven by proxy voting12.

For example, after First Solar's 2024 AGM, we expressed disappointment in its decision to appoint another male board member, missing an opportunity to honour its public commitments to diversity, sustainability, and equity. Conversely, Thermo Fisher Scientific improved female board representation by 10% and achieved 48% female representation across its business13, earning our commendation.

Since we began closely monitoring gender diversity in 2018, improvements from companies like Thermo Fisher have become more common, driving the strategy’s gender diversity performance from 19% to 29.6%14.

But limited data on DEI aspects beyond gender can complicate engagement, particularly with respect to setting targets, highlighting the need to assess alternative indicators of progress15.

For example, we engaged Infineon16 to increase the ambition and scope of its diversity targets. Though it does not plan to revise existing goals, the company highlighted its commitment to initiatives like employee resource groups (ERGs), monitoring employee satisfaction, and enabling flexible working arrangements.

Last year we refined our prioritisation method on DEI by identifying laggards with low senior female representation – a datapoint available across the portfolio - and assessing management’s prioritisation of DEI17(Figure 3). This will guide 2025 engagement.

Figure 3: Mapping gender diversity priorities within the FP WHEB Sustainability Impact Fund

3. Protecting biodiversity, nature and the environment

In 2024, we advanced on initiatives to enhance ecological outcomes. This included advocating for MSA Safety18 to commit to a phase-out of PFAS chemicals in firefighter gear, now that PFAS-free alternatives are available. We also led a collaborative engagement with Ecolab through ChemSec’s Investor Initiative on Hazardous Chemicals19, pushing for a time-bound phase-out of substances of very high concern (SVHC), enhanced product circularity, and better promotion of safer alternatives.

In response to antimicrobial resistance (AMR) becoming a key priority for institutional clients, we joined the Investor Action on Antimicrobial Resistance Initiative (IAAMR)20. We believe our involvement in policy advocacy on AMR through this initiative will complement our investments in companies whose products and services help mitigate the risk of micropollution, which is a key driver of AMR21.

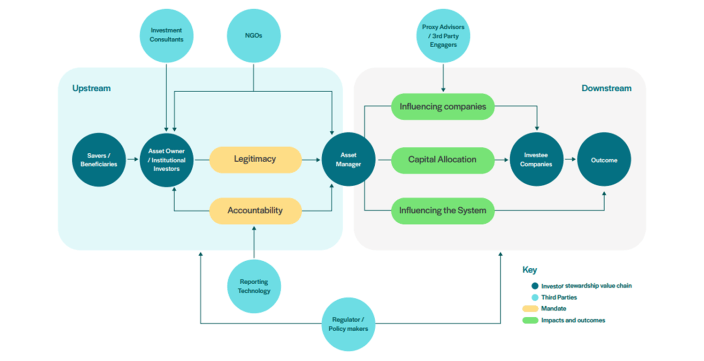

4. Supporting a well-functioning sustainable financial system

WHEB’s stewardship efforts aim to influence systems more broadly through policy advocacy and contributions to policies, regulations, and thought leadership that advance sustainable investment (Figure 4).

Figure 4: The ‘ecosystem’ of investor stewardship

Key achievements last year included

- The publication of WHEB’s Stewardship White Paper: in which we examine the obstacles to effective stewardship and engagement, highlighting practical solutions employed by WHEB and other practitioners to deliver long-term client value. This paper has been positively received and has been helpful in informing our feedback to the Financial Reporting Council’s (FRC) Stewardship Code Consultation22. Specifically, we are keen for the Code to retain its existing level of ambition for addressing systemic risks, and we hope that the FRC will enable more consistent use of terminology such as ‘objectives’, ‘outcomes’ and ‘activities’.

- SDR Sustainability Impact Label: The FP WHEB Sustainability Impact Fund became the first listed equity fund to use the “Sustainable Impact” label under the Financial Conduct Authority’s Sustainability Disclosure Regime (SDR). This recognition underscores the strength and credibility of WHEB’s stewardship and engagement practices for addressing sustainability risks and opportunities and delivering lasting client value.

Conclusion

Reflecting on 2024, we celebrate significant progress in the portfolio on our key stewardship priorities. We are conscious though that political developments and higher client expectations of stewardship quality could intensify pressures on this practice in the year to come.

Still, we remain optimistic that the foundational work we have undertaken this year will strengthen WHEB’s ability to deliver resilient and impactful investor contribution and long-term client value.

Sign up here to receive our monthly and quarterly commentaries in your inbox.

1 https://www.whebgroup.com/assets/files/uploads/20230424-nzc-policy-portfolio-emissions-final.pdf

2 These commitments preceded our involvement with the Net Zero Asset Managers’ Initiative. We note the initiative has decided to suspend activities to track signatory implementation and reporting in order to conduct a review into its appropriateness in the current geopolitical environment. We await the conclusions of the review and in the meantime will continue to report progress against our commitments.

3 This proportion relates to the FP WHEB Sustainability Impact Fund and includes companies that have either a SBTi-validated near term target, a SBTi-validated Net Zero target or companies that have a clearly stated Net Zero Carbon target.

4 https://www.te.com/content/dam/te-com/documents/about-te/corporate-responsibility/global/TEConnectivityCorporateResponsibilityReport2023.pdf

5 https://www.whebgroup.com/te-connectivity-nzc-case-study

6 Based on 3Q2024 company guidance.

7 This is expected to displace 7,000 kilotons of CO2e emissions over the 15 year duration of the Power Purchase Agreement.

8 https://www.whebgroup.com/engagement-case-study-net-zero-carbon-at-first-solar-q1-2024

9 Data relates to emissions emitted in 2022, 2021 and 2020 but reported in 2023, 2022 and 2021 respectively.

10 https://medium.com/@alex.edmans/is-there-really-a-business-case-for-diversity-c58ef67ebffa

11 https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3933687

12 On average 4-12% of WHEB’s votes against management can be attributed to opposing boards with less than 33% female representation.

13 https://corporate.thermofisher.com/content/dam/tfcorpsite/documents/corporate-social-responsibility/annual-reports/2023-CSR-Report.pdf

14We use Impact Cubed gender equality analysis which looks at the percentage of female executives and board members.

15 https://www.whebgroup.com/our-thoughts/dei-evolution-looking-beyond-gender-and-facing-the-facts

16 https://www.whebgroup.com/infineon-technologies-2024-q1-case-study

17 Please refer to our prevous blog on this issue for more details of this assessment: https://www.whebgroup.com/our-thoughts/dei-evolution-looking-beyond-gender-and-facing-the-facts

18 https://www.whebgroup.com/msa-safety-pfas-phase-out-q3-2024

19 https://www.whebgroup.com/ecolab-engagement-case-study-chemicals

20 https://amrinvestoraction.org/article/wheb

21 https://www.whebgroup.com/our-thoughts/stewardship-in-the-spotlight-managing-micropollution

22 https://www.frc.org.uk/consultations/stewardship-code-consultation/