Navigating policy uncertainty in sustainable investing – why stock selection matters

In Q1’s quarterly webinar we discussed the negative sentiment towards electric vehicles (EVs), the headwinds facing Clean Energy companies and the risk that Trump would try to repeal elements of the Inflation Reduction Act (IRA) in the US if he comes into power later this year.

Underneath the surface of those topics is a complex mix of issues including climate policy, trade policy and regional protectionism and the demand environment. Some of these factors are pointing in different directions in terms of whether they are “good” or “bad” for sustainability and for companies in our portfolio.

In this article we will look at those issues and how they are influencing our thinking, both in the near-term and over a longer time horizon. While the picture may be complicated, we believe that there is still significant support for the structural sustainability drivers that underpin our investments.

Climate policy

Over the past few years, we’ve seen the launch of several high-profile climate package policies. The US introduced the Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act (IIJA), Europe announced its Green Deal and China formalised its “dual-carbon goals” with 2030 and 2060 emissions targets.

These packages support growth across multiple themes and sub-themes within the portfolio. As an example, the IRA and IIJA cover renewable energy, electric vehicles, hydrogen, water infrastructure and buildings. Together they invest over $1 trillion to address climate needs.1

Last year, more solar panels were installed in China than the US installed in its entire history2 and the government is likely to exceed its renewables installation and non-fossil energy targets.3 China is also the world’s largest EV market with sales expected to account for half of all car sales this year.4 This compares to an expected penetration rate of around 11% in the US and 28% in Europe.

Against that backdrop it may seem surprising that Clean Energy and Sustainable Transport returns have lagged within the portfolio, but we believe there are three reasons for this. First, the risk that policy may change. Second, protectionist trade policies around the world are complicating the impact of climate policies. Third, there is a question about which companies will be able to generate positive equity value from addressing climate change.

Policy risk

We wrote about the growing trend of watered-down environmental policies in a previous blog.5 Since then, we’ve seen the EU making concessions to farmers following protests.6 The Scottish government scrapping its ambitious net-zero targets after a damning report by its independent advisers who warned that they were no longer credible.7 And in the US, the Environmental Protection Agency (EPA) watering down tailpipe emission limits to allow a slower adoption rate of EVs.8

Despite the headlines, things are nonetheless moving in the right direction. The IEA predicts that demand for coal, oil and natural gas will peak this decade even without any new policies.9 A study by Ember released in early May goes even further, anticipating that global power sector greenhouse gas emissions will peak as soon as 2024.10 Once up and running, currently announced manufacturing capacity additions in solar and batteries would be enough to meet demand by 2030.11 In April the G7 countries, which together account for 20% of global emissions, also reached a milestone agreement to phase out the unabated use of coal by 2035. This sends a clear message to the rest of the world.

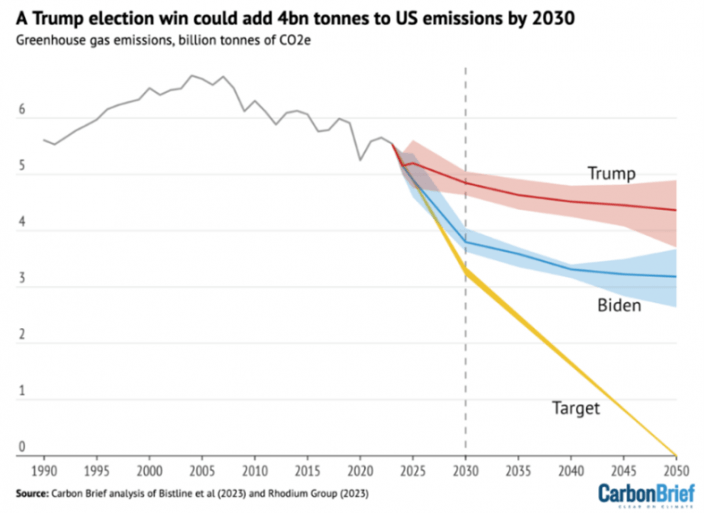

It seems clear that the tide has turned. The issue now is one of speed not direction. The potential for repeal of the IRA under a Trump administration is a good example. Emissions would still decline but they would fall at a much lower rate than under Biden’s policies. But both of those scenarios still fall short of what’s needed.12

Green trade tensions

Policy support is uncertain and needs to improve. However, we see increasing positive momentum from companies setting their own climate and nature-based targets which drives demand for our investments. Trane Technologies and Schneider Electric, companies we discussed in our most recent webinar, are two examples in heating, ventilation and air conditioning (HVAC) and electric components and software respectively which are benefiting from this in their results.

One complicating factor in the current environment is the way that climate policy is interacting with trade policy. For example, the US has introduced several measures to severely limit the import of Chinese solar panels. China on the other hand has excess supply because their weak economy is supressing demand. That excess can’t go to the US and so Europe has to absorb a lot of it, resulting in pressure on pricing.13

The EV supply chain is another example of this complicated dynamic. EVs contain more semiconductor content than traditional vehicles so they are a great opportunity for semiconductor companies. However, there is a big push in China to grow the local value chain which means Chinese EV manufacturers are under pressure to use as much Chinese content as possible.

In Europe and the US there is also an increasing focus on creating a more regional supply chain. The US CHIPS Act and the EU Chips Act both have the aim of increasing supply chain resilience and protecting against Chinese technology advancements for security reasons. As a result, the US is projected to triple its manufacturing capacity by 2032, the fastest rate of growth globally.14

What does it mean for investment opportunities?

The answer is: it depends. There are a lot of moving parts to this complex landscape. That’s why we think bottom-up analysis and a fundamentals-driven approach to investing is so important in the sustainability space.

One area of focus for us is technology innovation creating a defensible moat around the business. If a company has technology that others can’t replicate this can help protect against some of the protectionist measures. Infineon is a good example – it’s the number one player in Micro Controller Units (MCUs). While Chinese companies are catching up in some technologies, they are significantly behind in MCU technology with a very small market share. Infineon’s head start and continued focus on product development stands the company in good stead to defend its position.

Source: Infineon

Another consideration is end-market exposure. In Clean Energy, First Solar is US-focused and a clear beneficiary of the shift to more US manufacturing. Many of our environmental themes also have diverse industry exposures, including exposure to commercial customers where the economic case is more compelling and less sensitive to interest rates.

In Sustainable Transport we have no direct original equipment manufacturer (OEM) exposure. We believe our holdings should benefit regardless of which car brands are the winners and the geographic mix of growth. Aptiv is a good example. It’s a tier one supplier of electrical components and software which has been announcing increasing design wins with Chinese OEMs as those companies take share in the global market.

There will be winners and losers in the transition. We think the companies that can capture the opportunities in the shift to a green economy will be well placed to outperform over the coming years.

Sign up here to receive our monthly and quarterly commentaries in your inbox.

1 https://www.brookings.edu/articles/why-workforce-development-is-crucial-to-new-infrastructure-and-clean-energy-investments/

2 https://www.vox.com/climate/24139383/climate-change-peak-greenhouse-gas-emissions-action

3 https://www.carbonbrief.org/guest-post-why-china-is-set-to-significantly-overachieve-its-2030-climate-goals

4 https://www.ft.com/content/5b8a02ab-2d0d-4459-85fb-4ae500de494f

5 https://www.whebgroup.com/our-thoughts/environmental-policies-vs-economic-realities-unravelling-the-conundrum-amid-a-cost-of-living-crisis

6 https://www.politico.eu/article/france-tractors-farmer-protests-gabriel-attal-emmanuel-macron/

7 https://www.politico.eu/article/scottish-government-abandons-flagship-climate-goal-mari-mcallan-says/

8 https://www.reuters.com/business/autos-transportation/biden-administration-relax-ev-rule-tailpipe-emissions-ny-times-2024-02-18/

9 https://iea.blob.core.windows.net/assets/ac433d3a-3f9e-482e-b8bf-17653b1c4024/NetZeroRoadmap-2023Update-ExecutiveSummary.pdf

10 https://ember-climate.org/insights/research/global-electricity-review-2024/#about

11 https://iea.blob.core.windows.net/assets/ac433d3a-3f9e-482e-b8bf-17653b1c4024/NetZeroRoadmap-2023Update-ExecutiveSummary.pdf

12 https://www.vox.com/climate/24139383/climate-change-peak-greenhouse-gas-emissions-action

13 https://www.ft.com/content/2ea6bf6d-04e9-453b-a35f-cd6431cfc7bf

14 https://www.semiconductors.org/america-projected-to-triple-semiconductor-manufacturing-capacity-by-2032-the-largest-rate-of-growth-in-the-world