DEI Evolution: looking beyond gender and facing the facts

The term Diversity, Equity and Inclusion, also known as “DEI”, has become laden with political charge.

If you think that’s an overstatement, then cast your mind back to March this year. Right-wing conservatives in the US were quick to blame ‘Baltimore’s DEI Mayor’ after the city’s bridge collapsed when a 1,000 foot cargo ship collided with it1. And only two months earlier, Elon Musk sought to settle a spat with fellow billionaire Mark Cuban about the value of corporate DEI programmes via UFC-style cage fight 2.

Amid these surreal controversies, it's crucial to remember the purpose of DEI programs. They are meant to strengthen organisations by:

· Embracing diverse identities (for example: gender, ethnicity, age, physical ability, religion, class, neurodiversity, and cognitive diversity).

· Ensuring equity, which involves fair treatment considering individual circumstances.

· Promoting inclusion, creating a culture where all employees feel heard.

In WHEB’s view, improving DEI is the right thing to do from a moral and social standpoint. This view should suffice when seeking DEI-related improvements in investee companies.

Conversely, the broader investment community has preferred to advocate for improvements in DEI based primarily on a business case. Alex Edmans, Professor of Finance, points out3 that the business case has too often been based on influential yet flawed studies4,5,6. Specifically, these studies have lacked replicable evidence and face significant methodological issues regarding the link between diversity and improved financial performance.

However, Edmans does highlight evidence suggesting a possible link between DEI-related practices and financial benefits. The 100 Best Companies to Work For in America are found to have higher shareholder returns than their peers. Crucially, though, the correlation is between higher employee satisfaction - which the Best Companies ranking evaluates - and shareholder returns. However, employee satisfaction and good diversity and inclusion share some characteristics.7,8

DEI: A great concept but execution leaves room for improvement.

Contrary to the narratives promoted by conservative think tanks in the US9, DEI initiatives are not a zero-sum game benefiting some people at the cost of others. Instead, the aim is to create a culture and environment in which all employees feel accepted and free to be themselves, which boosts happiness and, in turn, productivity. This leads to benefits for the business such as improved innovation, creativity and problem-solving. In fact, a need to belong is so hardwired into our DNA that it’s been linked with an increase in job performance by over 50%.10

But, a hard truth is that poor execution of DEI initiatives undermines its potential. For example, 'quick-fix' interventions, like DEI training, can create a false perception of company commitment, or can alienate others leaving them feeling defensive and insecure. 11 All of this fuels the backlash against DEI and underscores the need for long-term strategy to improve and measure outcomes. Addressing this problem is part of WHEB’s investor stewardship duties, which aim to creating long-term client value and benefits for society, the economy and the environment.

WHEB’s approach to DEI to date

WHEB’s approach on DEI has predominantly focused on gender diversity. Admittedly, this is a narrower focus than we would like as it is a many-faceted issue. But the reality is that it is one aspect of DEI where data is available and comparable across the portfolio. WHEB’s voting policy therefore mandates at least 33% female board-level representation12. This leads to 4-12% of votes against management annually, and 6-8% of engagement activity related to gender diversity.

Data from Impact Cubed shows that gender diversity13 improved in the WHEB strategy from 2018 – 2023, from 19% to 27%14. While this progress is clearly not just due to WHEB’s stewardship work, it does show a link between our efforts and positive outcomes at our investee companies.

Looking ahead: refining the framework for DEI

Despite these improvements, gender equality remains elusive and is only one aspect of DEI. With the development of the Impact Research Team in 2022, WHEB is now committed to pushing for broader DEI changes across the portfolio.

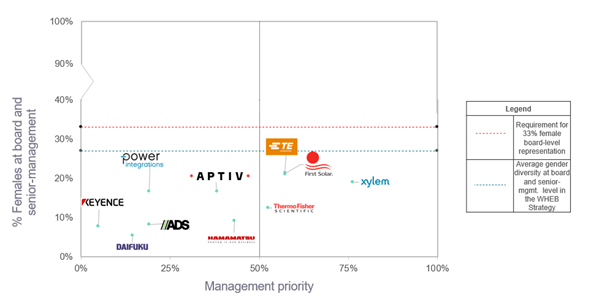

As a starting point, we are refining how we approach gender. To do this, we have identified the ten companies with the lowest gender diversity at Board and senior management level15. We have also assessed management’s priority in addressing the topic, indicated by related targets, commitments or goals, talent pipeline plans, disclosure of diversity data, previous engagement responses and supply-chain diversity efforts (Figure 1). This has helped us to identify the most significant laggards as targets for engagement, as well as potential areas for improvement. WHEB aims to expand this framework to track data changes over time and correlate outcomes with engagement activities.

Figure 1: Mapping gender diversity priorities within the FP WHEB Sustainability Fund

Reliable data on other diversity characteristics remains scarce. The US Supreme Court ruling effectively banning affirmative action16 is unlikely to help. In fact, lawyers are advising US companies to reconsider diversity metrics and avoid events targeting specific groups to prevent accusations of “reverse discrimination”.17

However, we are committed to applying a similar framework to evaluate companies’ broader DEI approach. As shown by our recent work with Infineon18, we are initiating dialogue on DEI alongside developing a framework.

We will likely centre our evaluation on employee satisfaction as an indicator of an inclusive corporate culture; evidence of diversity and employee development programmes; workplace policies to prevent discrimination; and ensuring freedom of association and supplier and community engagement. It is also crucial that companies employ a comprehensive approach that combines immediate actions with sustained efforts to genuinely advance DEI.

Conclusion

DEI is a critical yet contentious issue. Despite political backlash and execution challenges, well implemented efforts to improve DEI have the potential to foster diverse identities, ensure equity, and promote inclusion, strengthening organizations and society more broadly.

While WHEB has seen positive outcomes in gender diversity within our portfolio, we are also committed to advancing broader DEI goals. To do this, we will continue to leverage our expert knowledge of investee companies, to evaluate their performance and determine priorities.

Sign up here to receive our monthly and quarterly commentaries in your inbox.

1 https://www.forbes.com/sites/janicegassam/2024/03/27/baltimore-bridge-collapse-creates-more-dei-attacks-how-allies-can-push-back/

2 https://www.forbes.com/sites/dereksaul/2024/01/09/elon-musk-calls-mark-cuban-racist-over-dei-support-as-feud-continues/?sh=756cfa8d73a3

3 https://medium.com/@alex.edmans/is-there-really-a-business-case-for-diversity-c58ef67ebffa

4 McKinsey produced a series of ‘Diversity Matters/Delivers/Wins’ studies correlating ethinic/racial diversity with finacial performance https://www.insurance.ca.gov/diversity/41-ISDGBD/GBDExternal/upload/McKinseyDivmatters-201501.pdf

5 The McKinsey studies have been found to contain basic errors https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3849562

6 This study was commisioned by the FRC and claims to show a positive correlation between higher leves of gender diversity and better future financial performance. https://downloads.ctfassets.net/hxo16fanegqh/2bnvaruy1KDkblph2XdFIW/2a951715edd7c5d67c9f04dd5ef09ae5/frc-board-diversity-and-effectiveness-in-ftse-350-companies.pdf

7 https://medium.com/@alex.edmans/is-there-really-a-business-case-for-diversity-c58ef67ebffa

8 https://dx.doi.org/10.2139/ssrn.3933687

9https://www.nytimes.com/interactive/2024/01/20/us/dei-woke-claremont-institute.html

10 https://hbr.org/2019/12/the-value-of-belonging-at-work

11 https://www.forbes.com/sites/teresahopke/2024/01/31/what-companies-are-getting-wrong-about-dei/

12 Combined reporting and targets that, for example, report gender and minority ethnic representation in a single number are not acceptable.

13 This covers gender diversity of both board and senior management positions

14 We are pleased to be closing the gap between the WHEB Strategy and its benchmark, the MSCI World, which we attribute to a slight overweight in traditionally male-dominated industries and which has seen a slightly smaller improvement of around 6%, from 22% to 28% in the same timeframe.

15 according to Impact Cubed,

16 https://www.bbc.co.uk/news/world-us-canada-65886212

17 https://www.pionline.com/esg/wall-streets-dei-retreat-has-officially-begun

18 https://www.whebgroup.com/infineon-technologies-2024-q1-case-study