Stewardship in the spotlight: The stewardship stampede

Levels of stewardship activity have never been higher. Whilst by no means a new feature of the investment industry, in 2023 stewardship became a core activity for many asset managers and owners.

For sustainability investors, in the UK at least, the high profile for stewardship has been cemented by the FCA's Sustainability Disclosure Requirements (SDR). Published at the end of last year, this policy includes a notable focus on investor stewardship for all four of its labels1. Internationally, the Global Impact Investing Institute (GIIN) also recognises stewardship's role in impact investing.

Since 2022, UK Pension schemes with more than 100 members have been expected to state their – or their external managers’ – engagement policy and priorities and explain in detail how they steward their sustainable investments. This in turn has encouraged underlying asset managers to develop their own policies and systems to meet these expectations. It is perhaps no wonder then that the 2020 UK Stewardship Code continues to gain signatories. Up from 236 at the end of 2022, and now standing at 277, 68% of these are asset managers2.

Quantity over quality?

This new impetus for engagement is having an impact on the levels of engagement activity reported by asset managers. In a study by the investment consultants Redington, one asset manager reported that they had undertaken more than 10,000 engagement actions with the 2,000 companies that they own3. The report’s authors conclude that ‘not all engagement is created equal [and therefore], we can’t rely on the raw numbers to tell us what’s going on.’

In fact, prioritising quantity over quality very much seems to have been the reaction of much of the market. For example, in 2023 asset managers’ stewardship efforts came under fire on multiple fronts including misalignment with client values4; lack of consistency in voting activities5; low-quality efforts and under-resourcing6; and ineffective escalation7 to name a few.

Elsewhere in 2023, to combat greenwashing, some managers have tried to show proof of additionality or "engagement alpha", for example through joint statements between investors and even the companies themselves8.

While we don’t think this is the answer (or the best use of time), we do acknowledge what this, along with these other issues, is ultimately telling us: there is a lack of consensus on what ‘good’ investor stewardship looks like and how asset managers should manage, assess and report their activities.

Minding the gap

The good news, in our view, is that these issues represent ‘growing pains’. While there’s discomfort now, there lies an opportunity for the industry to learn from the pain points to build a collective understanding of what constitutes ‘good stewardship’ and strengthen practices.

WHEB’s approach to engagement and voting is well established9 and underpinned by extensive research, analysis, and policy development. Nonetheless, 2023 has still proven to be a foundational year for us as we have worked to elevate the overall quality of what we do. Predominantly, this work has comprised:

1. Focusing on outcomes (not just activity) and how this links to long-term value creation

Ultimately, our company engagement activity is focused on encouraging companies to address issues that we think will help them be successful. Asset managers need, in our view, to demonstrate how their stewardship and engagement activity contributes to this long-term value creation. We will address how we select these issues in a future blog.

We are clear though that outcomes are ultimately what matter. Reporting should therefore focus on achieving good outcomes, not just engagement activity. At the same time, we are careful about attributing outcomes specifically to our engagement, which we see as deeply problematic. Changes in company policy and performance are almost always the result of multiple efforts from a variety of stakeholders.

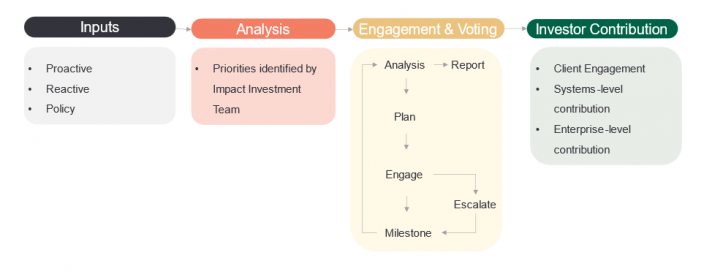

Nonetheless, it is possible to show a correlation. We believe this begins with a systematic approach to engagement (Figure 1), comprising:

1. Identifying the issues on which to engage whether proactively or reactively (the ‘inputs’);

2. Prioritising material issues and setting long-term objectives and relevant engagement milestones;

3. ‘Engaging and voting’ (iteratively) to achieve progress against these milestones and feeding this back into our investment analysis which,

4. along with our reporting of progress to clients and other stakeholders, represents our “Investor Contribution” to positive impact.

Our work to address biodiversity across the portfolio, which we wrote about recently10, is an example of this approach in practice.

Figure 1. A systematic approach to managing company engagement

2. How effective is our engagement?

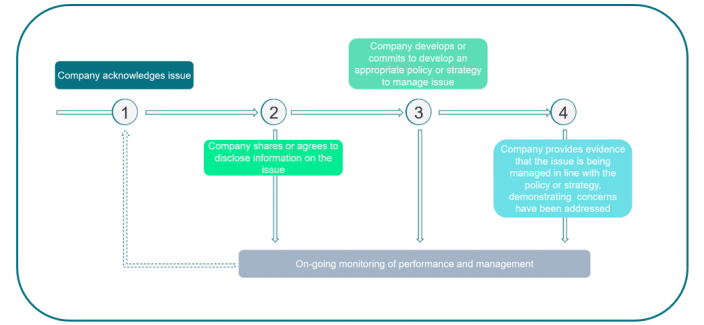

We’ve also developed a more rigorous approach to assessing the effectiveness of our engagement. This involves setting specific outcome milestones for each engagement. These milestones start with the company acknowledging the issue and conclude with clear evidence that the issue is being effectively addressed, and are shown in Figure 2.

Figure 2: WHEB’s objective milestones

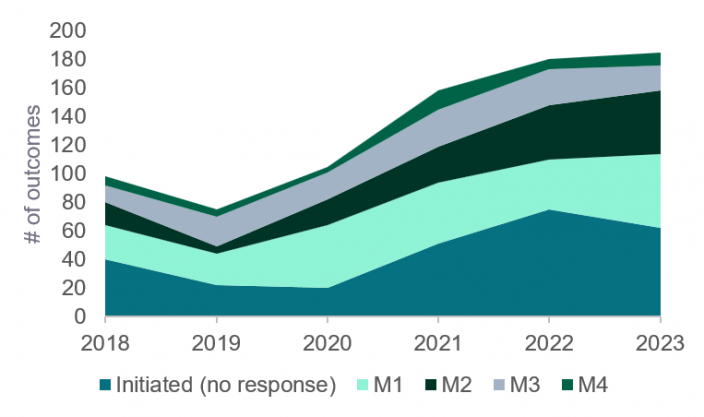

During 2023 we reviewed our engagement activities over the past six years to identify the milestones that have been achieved over this period. Figure 3 shows how the overall amount of engagement has increased during this period, with a greater number of engagements initiated from 2020 – 2022. In turn, this has fed into a proportionally larger number of Milestone 1 (M1) and Milestone 2 (M2) outcomes.

As illustrated in Figure 2, we don’t expect every engagement to conclude with an M4 milestone, but with WHEB’s engagement objectives often targeting ambitious, long-term changes to strategy and policy, we hope that over time we will see an increase in Milestones 3 and 4 (M3, M4). We will be publishing more insights from this analysis in our forthcoming Stewardship Report.

Figure 3: Milestone progress 2018-2023

3. Making disclosures meaningful

We’ve previously written about11 our ‘radically transparent’ and comprehensive reporting, which extends to all of our engagement and voting work. Though serving as a form of assurance for our investors, we understand that this alone is not always helpful as navigating large volumes of data can be a challenge.

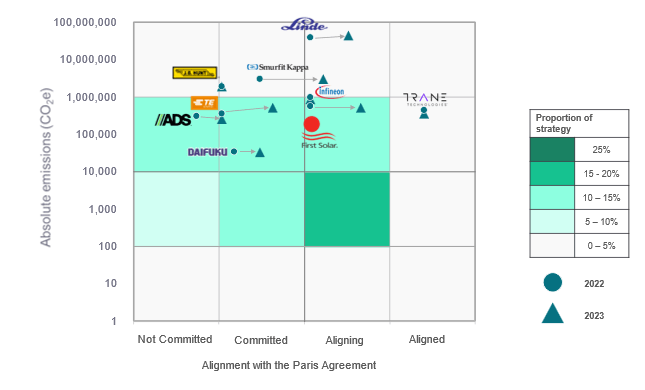

In our efforts to avoid both the ‘Scylla’ of cherry-picked anecdotes as well as the ‘Charybdis’ of meaningless data, we have developed complementary disclosures to evidence how our actions align with client priorities and values. We hope this makes them more meaningful. So far, efforts have centered around demonstrating overall progress on the highest priority issues. Figure 4, for example, shows how the biggest emitters of greenhouse gases (GHGs) in WHEB’s portfolio have changed their emissions between 2022 (dots) and 2023 (triangles), and also whether their approach to managing their emissions has become more or less aligned with the Paris Agreement.

Figure 4: WHEB’s investor contribution to progressing core sustainability issues

Currently, we are working to develop this visualization tool further and to expand coverage to other key stewardship priorities such as gender diversity, biodiversity, and executive remuneration.

Conclusions

Our ambition is to give our clients the tools to see how their investments with WHEB are helping to deliver positive change through the engagement work that we do. As we head into 2024, the ability of investment managers to successfully deliver on stewardship will, in our view, depend on considered, systematic stewardship processes, underpinned by robust systems, resources, and meaningful reporting.

Sign up here to receive our monthly and quarterly commentaries in your inbox.

1 https://www.fca.org.uk/publication/policy/ps23-16.pdf

2 https://esgclarity.com/uk-stewardship-code-signatories-grow-to-277/

3 https://redington.co.uk/wp-content/uploads/2022/12/Redington-Stewardship-Code-reporting-FINAL.pdf

4 Hoepner, Andreas G. F., UK Asset Owner Stewardship Review 2023: Understanding the Degree & Distribution of Asset Manager Voting Alignment (November 17, 2023). Available at SSRN: https://ssrn.com/abstract=4643377 or http://dx.doi.org/10.2139/ssrn.4643377

5 https://www.responsible-investor.com/manager-inconsistency-on-stewardship-drives-growing-frustration-among-uk-asset-owners/

6 https://www.responsible-investor.com/under-resourced-and-ineffective-industry-leaders-deliver-gloomy-verdict-on-stewardship/

7 https://cdn2.assets-servd.host/shareaction-api/production/resources/reports/UNDER-EMBARGO-RISE-Paper-2_Introducing-a-standardised-framework-for-escalating-with-companies.pdf

8 https://www.responsible-investor.com/engagement-claims-without-additionality-pose-greenwash-risk-says-ca100-chair/

9 Stewardship has been a core aspect of our offering and we have been reporting on progress quarterly since 2016.

10 https://www.whebgroup.com/our-thoughts/stewardship-in-the-spotlight-nature-calls-from-assessment-to-action

11 https://www.whebgroup.com/our-thoughts/stewardship-in-the-spotlight-achieving-accountability-while-avoiding-engagement-washing