Stewardship in the spotlight: Achieving accountability while avoiding “engagement-washing”

It’s no wonder “Engagement-washing” is the latest term to do the rounds given the number of regulatory forces that are driving responsible investors to demonstrate how effective they are at delivering real change1.

As you’ve probably guessed already, ‘engagement-washing’ occurs when investors overstate their actions or involvement in advancing sustainability outcomes when engaging. It also covers investors that exaggerate their role and contribution to outcomes when other investors have also been involved.

Evidence shows engagement-washing is a real concern. After analysing 36 Stewardship Code Reports, investment consultant Redington2 recently discovered that managers over-emphasise quantity over quality in their reporting. Ultimately investors engage with investee businesses to change aspects of those businesses. It is not clear that the raw number of engagements is a good measure of this. There are also questions about the usefulness of the “number of engagements” metric due to major inconsistencies in how engagements get counted.

Meanwhile, some other basic but insightful statistical data, such as the split of engagements between ‘E’, ‘S’ and ‘G’ or the proportion of votes cast by management, are omitted by up to a third of the sample analysed3.

Hitting the target but missing the point

A pre-occupation with wishing to ‘look busy’ misallocates resources that could be better spent on working towards actual engagement outcomes and exacerbates existing information asymmetries.

It also perhaps indicates that some managers are only providing a superficial level of reporting because they lack adequate strategies, processes or systems for conducting, and therefore reporting on, proactive and ambitious stewardship.

Meaningful, consistent and timely information is critical if asset owners and end investors are to assess how well asset managers exercise their stewardship responsibilities and determine alignment of strategies and values.

It's certainly a positive that more managers are disclosing stewardship activities4, but there is a lack of detailed guidance on what to report. To prevent “engagement-washing”, comprehensive minimum standards on the quality of the stewardship reporting are needed.

Embarking on a quest for quality

Given the variety of approaches used in engagement and voting, and the differences in how these are applied across asset classes, developing comprehensive standards will be no small feat. Still, there are promising signs of a move towards standardisation, some of which WHEB has been actively supporting.

For example, we have fed into the Financial Conduct Authority’s (FCA) Vote Reporting Group’s5 recent consultation via UK Sustainable Investment and Finance (UKSIF). We have also provided input into guidelines for credible engagement that are being developed by Shareholder’s for Change. Elsewhere, the Institutional Investors Group on Climate Change (IIGCC) has released a tool6 to promote consistent measuring of climate stewardship and engagement for asset managers and data collections for asset managers.

It will take time to finalise these standards and regulations. While we wait, WHEB has sought to develop our own approach to high quality stewardship and engagement reporting.

WHEB’s approach

WHEB’s award-winning7 approach is centred around the idea of “radical transparency” in sustainability, stewardship and engagement reporting:

- Total transparency: We report all our engagement activity in our quarterly reviews and our voting activity - on every resolution (including whether and how we voted with justifications for votes against management) in our voting records.

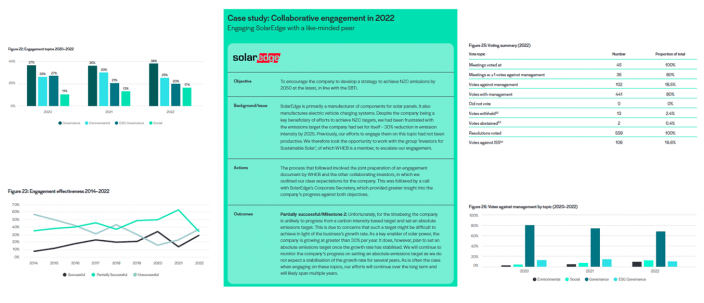

- Qualitative and quantitative information: This is complemented by both qualitative and quantitative summary information, which together allow a more complete understanding of our activities. This includes the proportion of engagements split by issue, geography and outcomes, as well as essential voting statistics8 (Figure 1). We also provide three case studies per quarter to illustrate how our policies and processes operate in practice. These narrative examples of our work are especially helpful for retail audiences that may be unable to compare manager performance across summary statistics.

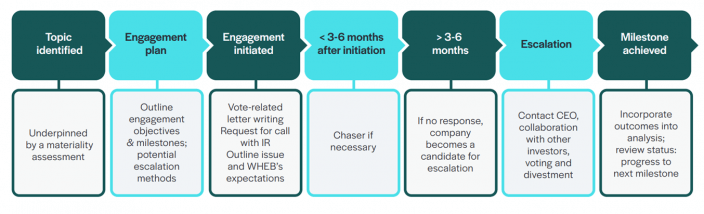

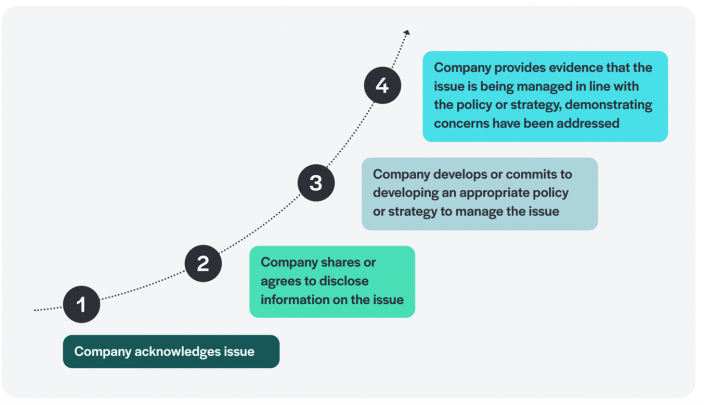

- Outlining processes: We provide detailed accounts of our stewardship processes (Figure 2), policies and activities in our Stewardship Reports while our Stewardship and Engagement Brochure is designed to provide a summary overview of these activities. This year both these documents set out how we have recently reviewed our processes and introduced new milestones for assessing progress against long-term objectives (Figure 3).

- Attributing outcomes: It is difficult for investors to directly attribute engagement outcomes to their engagement and we are careful not to overstate this in our reporting. In general, we believe that it is collective engagement by multiple stakeholders that is most effective at achieving positive change at investee companies.

- Collaboration and work on public policy: We document the collaborative and policy initiatives we contribute to, also setting out the nature of our involvement in supporting these activities .

- Incorporating feedback: Continual improvement is something we value deeply and we welcome any feedback on our approach. Reach out and let us know how we can improve our stewardship and engagement reporting. You can complete our client feedback form or email rachael.monteiro@whebgroup.com

Figure 1: WHEB’s engagement reporting includes proportion of engagements split by issue, geography and effectiveness, as well as essential voting statistics

Figure 2: WHEB’s stewardship process supports improvements in company strategy and performance

Figure 3: WHEB’s engagement milestones underpin long-term objectives

Sign up here to receive our monthly and quarterly commentaries in your inbox.

1 https://www.whebgroup.com/our-thoughts/stewardship-in-the-spotlight-our-hopes-for-voting-practices-in-2023

2 https://redington.co.uk/wp-content/uploads/2022/12/Redington-Stewardship-Code-reporting-FINAL.pdf

3 Ibid

4 https://www.frc.org.uk/getattachment/de8c91f5-c2cb-4b8b-9a98-34c31f382924/FRC-Influence-of-the-Stewardship-Code_July-2022.pdf

5 WHEB has fed into the consultation through our involvement with UK Sustainable Investment and Finance (UKSIF) https://www.fca.org.uk/firms/climate-change-and-sustainable-finance/vote-reporting-group

6 https://www.ipe.com/news/esg-roundup-asset-owners-move-to-standardise-climate-stewardship/10067127.article

7 https://www.environmental-finance.com/content/awards/sustainable-investment-awards-2023/winners/best-sustainability-reporting-by-an-asset-or-fund-manager-medium-and-small-wheb.html

8 We believe that % resolutions voted, % of votes against management and % of votes against ISS (our proxy advisor) demonstrate how we are exercising voting rights.