What are we doing?

Investors in the FP WHEB Sustainability Impact Fund will receive a letter this week saying that we are removing the MSCI World Index as a comparator benchmark for the Fund. Instead, the prospectus has been updated to state that the Fund is not managed with reference to or constrained by any benchmarks or indices, as the Authorised Corporate Director (FundRock in our case) does not consider that there is a representative index or sector that can be accurately used as a comparator benchmark.

Why are we doing this?

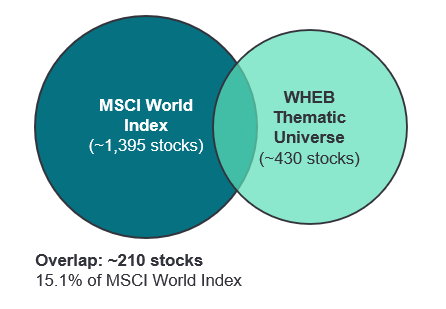

WHEB’s investment strategy is focused on companies that have a positive impact as their products or services provide a solution to a sustainability problem. Most companies in traditional index benchmarks do not meet this definition, and therefore are excluded from our investable universe, which typically overlaps with the MSCI World Index by only 15%. Significant sectors of the economy are excluded which are considered either to have negative sustainability impacts, or no identifiable or measurable positive impact. This means that the Fund portfolio tends to be absent from significant sectors of traditional indices, such as financials and energy; and has significant bias towards other parts of the market, such as health and industrials. As a result, investment returns are likely to be different to those of a larger unscreened universe in any given time period. This is not to say that returns should be better or worse, but they are likely to follow a different path.

Theme overlap1

Source: Factset as at 31 December 2024.

For much of the history of WHEB’s investment strategy, returns have been somewhat correlated with the index; in some periods impact stocks have outperformed, in other periods they have underperformed. However, in the past 3 to 4 years following the pandemic, returns from the positive impact universe have meaningfully underperformed the wider global equity indices. This has resulted from a number of factors, including higher interest rates and inflation, war in Ukraine and the Middle East, a retrenchment in global policy and politics towards a more sustainable economy and society, and the domination of markets by the so-called Magnificent Seven. In this environment, many of our clients have questioned whether the use of the MSCI World Index as a benchmark for the Fund represents a useful or meaningful comparison.

Why now?

The adoption by the Fund of the SDR Sustainability Impact Label in September 2024 underscores this difference. It clarifies to investors the nature of the Fund’s investments and differences to the wider market. Under the requirements of the Sustainability Impact Label, the Fund’s stated objective is to achieve a positive environmental and/or social impact as well as financial return (described as capital growth over five years).

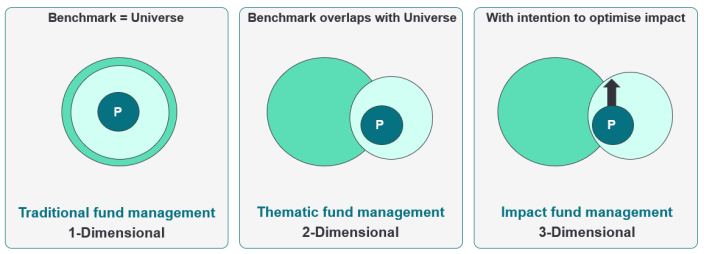

The Fund’s dual objectives are oversimplified and poorly communicated when using a broader market index benchmark. In practice, our objectives are bigger than this, and also multi-faceted. We often use the image below to describe the 3-dimensional nature of what we hope to achieve over the long term.

Given the need and desirability of investing in solutions to sustainability challenges, we believe that the universe of positive impact companies will be a good place to invest in the longer term. However, in the most recent period, as described above, that hasn’t been the case. This has, though, brought us to a point where impact stocks are, in our view, cheaper than they have been for quite some time, as we wrote about in December.

The outcomes we achieve are the result of both the strategic positioning of the Fund in impact stocks and also how we manage it, selecting stocks from our universe and building a portfolio. In an ideal world we’d like to be generating positive capital growth, see the universe outperform the wider market, and for our portfolio to outperform our opportunity set. These three objectives cannot be captured in a single number. And financial returns are not our only objective. It also matters how we have achieved those returns, both through the stocks we’ve invested in and the contribution we’ve made as investors through our engagement and stewardship.

No change for investors.

There will be no change in the way your Fund is managed, only the way that performance data is presented. Importantly, we are not changing anything about our investment process.

Many of our investors use their own benchmarks, which may be index or peer group benchmarks. When asked, we will continue to work with them to explain our performance in whichever context they find most helpful.

In our public materials, like factsheets and quarterly reports, we will show several comparisons to give context for returns and a comparison against other investments they might have chosen to make. These include the same MSCI World Index we’ve just removed as a benchmark to show what the investor might have earned if they had invested in a broad portfolio of global developed world equities. In addition, we will show the Bloomberg UK Govt 5-10 yr bond index to show what the investor might earn if they had invested in UK Government Debt, and the SONIA cash interest rate as a proxy for what the investor might be able to earn for cash deposits.

Overall, we believe this change will enable us to have a richer and more constructive conversation with investors about the returns we achieve on their behalf, and provide better information and transparency.

Sign up here to receive our monthly and quarterly commentaries in your inbox.