This monthly is different…

Last month, WHEB held its Annual Investor Conference in London. A tradition started in 2015, the event provides thought-provoking guest presentations, topical panels, and one-to-one discussions with experts or investee companies, as well as the annual strategy update from WHEB’s investment team - this year delivered by Ted Franks and Ty Lee.

The main strategy has had several years of difficult relative performance vs its historic key benchmark, the MSCI World Total Return Index. This clearly needs explaining and our strategy update tackled this issue head on. In this monthly, we want to share with you the main messages from the presentation.

Targeting impact and outperformance

WHEB’s investment strategy has twin objectives:

1) To achieve capital growth over 5 years

2) and to contribute to positive sustainability impact over this period1

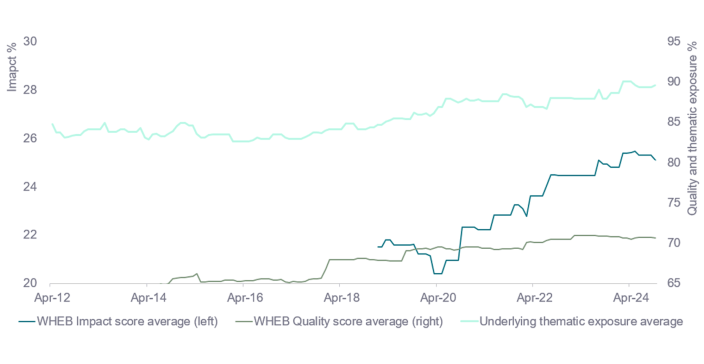

Let’s start off on a positive – we believe WHEB delivers very strongly on the second of these objectives. In fact, the average impact of our portfolio holdings as measured by WHEB’s proprietary “impact engine” has been steadily rising over the past four years, as has the quality of our holdings and the thematic exposure. The investment team is quite proud of its delivery on the impact calculator measures of the positive impact associated with an investment in the strategy2.

Figure 1: Long-term impact development3

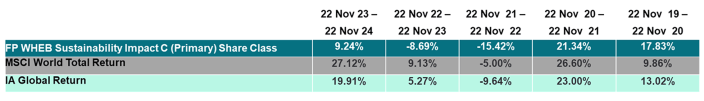

Moving on to investment returns, the last few years have been difficult for WHEB and impact-led strategies in general, as we can see from the below table. This shows us discrete five-year performance data on a net basis, which we customarily provide in our standard reports.

But it is important to remember that it hasn’t always been like this, as illustrated with additional longer-term data sets.

WHEB’s strategy traces its track record back to the end of 2005 and has always been long-term in its investment approach4. From the original launch of the strategy up until the end of 2020, investment returns compared relatively well to the MSCI World Index benchmark and to the broad peer group of global equity funds. But since then, returns have lagged these mainstream comparisons. The below data is presented on a gross basis, as opposed to the returns net of fees as shown in the previous chart, however, the underlying trend is clear.

Figure 2: Indicative gross returns since launch5

So has WHEB lost its mojo, or what has happened over the past 3-4 years?

There have been two key developments which we would characterise as “abnormal”. The first is what happened to the benchmark, the second being what happened since 2020.

Development 1: A closer look at the benchmark

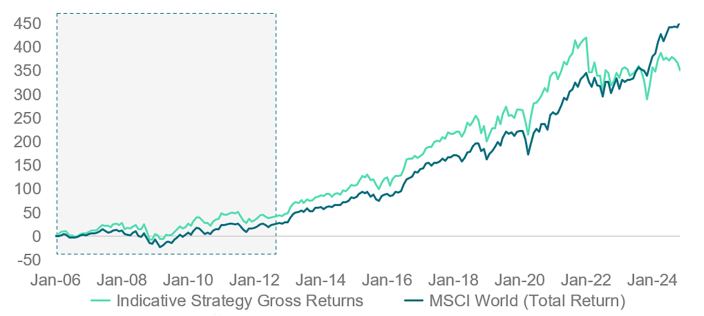

Over the past four years, the MSCI World Index has been increasingly taken over by the so-called magnificent seven (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, Tesla). These seven stocks now constitute almost 25% of the market cap of an index that comprises 1409 companies, and were a big component of the strong performance of the MSCI World in recent years.

Six of these stocks are not providing solutions to sustainability challenges, so they don’t have the positive impact we are looking for. Tesla is disqualified since, unusually, it fails on UN Global Compact criteria relating to freedom of association – not typically seen as a high bar.

Just to illustrate how extreme the current market concentration is, Nvidia alone has a larger market capitalisation than five of the G7 country stock markets.

Looking at the NASDAQ 100 Index, if it was a retail fund in Europe, it would be dangerously close to breaching what is known as the 5/10/40 concentration rule (which states that the combined position sizes in stocks over 5% cannot be more than 40% of the whole portfolio)6.

Figure 3: Historic stock market concentration7

The last time the stock market had a similar concentration was in the 1950s-1960s with the then magnificent seven (AT&T, General Motors, IBM, Standard Oil, General Electric, du Pont, and U.S. Steel)8. They are not that magnificent today – and indeed faded quite rapidly from their position of peak pre-eminence, in 1963.

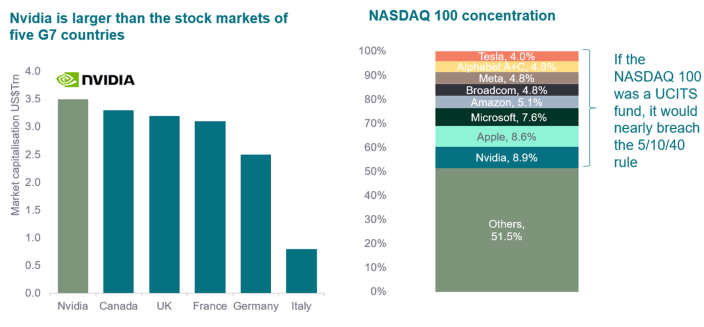

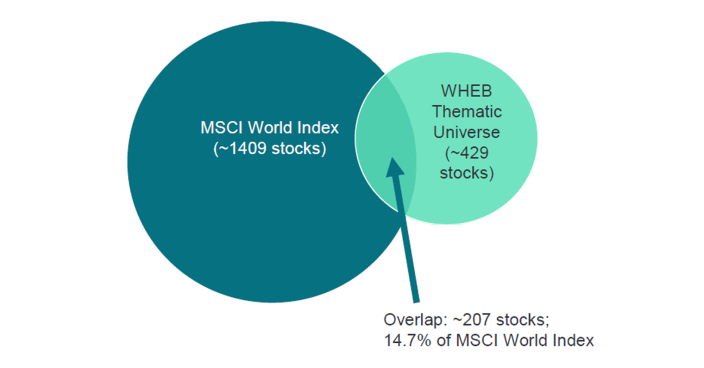

Moreover, the overall overlap with WHEB’s thematic universe of ~430 stocks is only ~15% which raises big questions about the suitability of the MSCI World as a benchmark for impact investing.

Ideally there would be a good alternative index for impact investing, but there is nothing yet on the market. We have looked.

Figure 4: Impactful stocks are a small proportion of the MSCI World Index9

Development 2: The strange past 3-4 years

In 2019/20 there was a lot of optimism in the impact space driven by the election of Joe Biden in the US and a global push from governments to commit to net zero carbon targets. The global Covid pandemic pushed the social agenda in health care. WHEB’s strategy has a strong exposure to health care and the energy transition agenda which resulted in strong performance at the time.

Since then, the world has seen a deeper pandemic than anticipated, a war in Europe, sky-rocketing inflation, a cost-of-living crisis, a supply-chain crisis, and the re-election of Donald Trump. A flourishing impact agenda sadly stalled and impact investing moved out of favour.

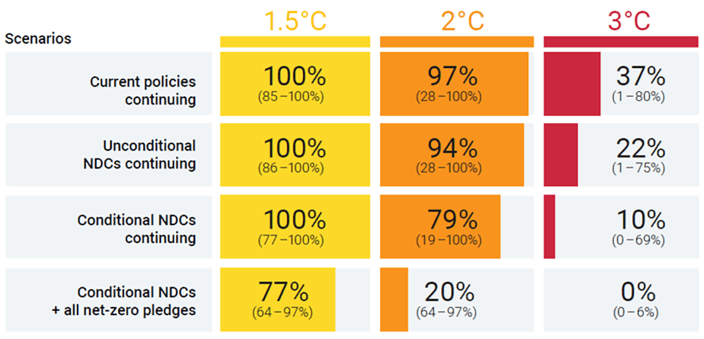

Figure 5: Likelihood of exceeding global warming temperature thresholds10

To highlight just a few specific aspects of this:

- The environmental agenda was not followed through as expected, meaning that the then global warming target of “at or below 1.5oC” has become a fantasy and even a greater than 2.0oC scenario is now more likely than not.

- Progress in healthcare turned into headwinds. Covid-related drivers and with it biotech funding evaporated, US drug price regulation moved back centre-stage with the “Medicare Drug Price Negotiation Program” and China started a resolute crack-down on corruption in healthcare which created a huge amount of collateral damage to the entire Chinese healthcare sector.

- High interest rates supported financials, the Ukraine invasion and Trump election supported oil and gas and financials stocks – both sectors WHEB is not invested in as they don’t qualify for our impact universe.

It’s always darkest before dawn

All this might make depressing reading, but our spirits are high and we believe we have good reasons to be optimistic regarding what’s to come.

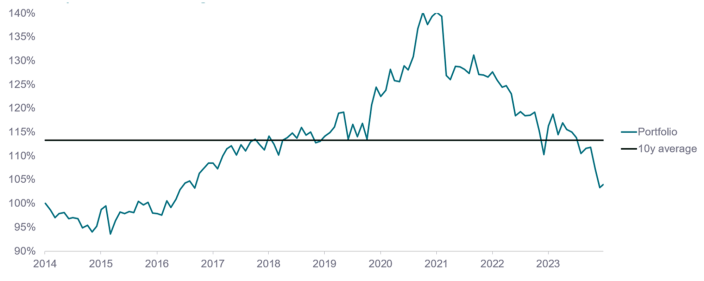

Figure 6: Portfolio price to forward earnings ratio, relative to local markets, rebased13

- Sentiment for impact investing is very, very low which can be seen in the portfolio valuation relative to local markets, such as Price to Earnings11 or Price to Book Value12 ratios. Markets usually turn when the last marginal seller has left.

- The urgency for climate action has never been greater and the means have never been more economically attractive. 2024 had a series of extreme weather events (e.g. hurricanes Helene and Milton in Florida, storm floods in Valencia) while clean power costs (e.g. solar and onshore wind) are now well below fossil-fuel based alternatives.14 Electric vehicles also often beat their corresponding internal combustion engines option on a total cost of ownership analysis.15 This will enable an increasing number of environmental markets to grow independently of the political environment.

- We are confident that most of the more strongly underperforming stocks in our portfolio have been hit by short-term issues the market is focussing on while the fundamental, longer-term investment case is as sound as ever, e.g. Spirax, AstraZeneca or ICON.

- While president-elect Donald Trump represents everything that WHEB opposes, we observe that historically, the strong deregulatory agenda put forward by Republican administrations has tended to powerfully support the mid-cap stocks that our strategy is most exposed to.

So we remain excited about the future and convinced that the opportunity has never been greater.

Sign up here to receive our monthly and quarterly commentaries in your inbox.

1 The investment and sustainability objective of WHEB’s reference account – the FP WHEB Sustainability Fund – was updated as of 20 September 2024 as the fund adopted the Sustainability Impact label in the UK. See https://www.whebgroup.com/impact-investment-funds/sustainability-fund-oeic/prospectus-fp-wheb-sustainability-fund-oeic for more detail.

2 See https://www.whebgroup.com/reporting-impact-investment/impact-calculator for more detail.

3 See our Impact Assessment and Measurement Methodology document https://www.whebgroup.com/assets/files/uploads/20240528-impact-measurement-methodology-final.pdf

4 In 2012, WHEB underwent significant expansion when joined together with the team that had formerly run the ‘Industries of the Future’ and ‘Global Care’ funds for Henderson Global Investors. The FP WHEB Sustainability Impact Fund was relaunched with the combined team from 30 April 2012, based on the Industries of the Future strategy, and therefore traces its track record back to the end of 2005, when the strategy was founded.

5This chart is provided for illustrative purposes only to provide a simulated long term track record for the strategy since 31/12/2005. The data reported in the shaded area relates to performance of the strategy prior to being managed by WHEB. Sources: Bloomberg, WHEB, MSCI. 30/09/2024. The composite returns calculation shows gross returns in the different vehicles since strategy launch as of 31/12/2005.

6 See https://maples.com/services/legal-services/funds-and-investment-management/eu-regulated-funds/ucits for more detail and explanation.

7 Country market capitalisations as of 24 October 2024. Sources: Apollo Academy, Apollo Global Management. Nasdaq 100 weights taken from Invesco Nasdaq ETF, 22 November 2024

8 https://globalfinancialdata.com/200-years-of-market-concentration

9 WHEB data as of 30/09/2024

10Emissions Gap Report 2024, UNEP

11 See https://www.investopedia.com/terms/p/price-earningsratio.asp for explanation of price to earnings ratio

12 See https://www.investopedia.com/terms/p/price-to-bookratio.asp for explanation of price to book value ratio

13 WHEB’s analysis. Mean ratio of price to next twelve months’ earnings by analyst consensus, FP WHEB Sustainability Impact Fund, excluding distortions from meaningless or negative denominators in five cases: FirstSolar, Advanced Drainage Systems, Vestas, Silicon Labs, and Autodesk. Source: Factset

14 IRENA - Renewable Power Generation Costs in 2023.

15 https://www.nrdc.org/stories/electric-vs-gas-cars-it-cheaper-drive-ev