Renewable energy and electrification can deliver 75% of the energy-related CO2 emissions reductions needed to keep global temperature increases “well below” 2°C.1 The question is: can the infrastructure cope?

Wind and solar energy sources are both variable and decentralised. In contrast, the existing electricity network was designed around very stable and centralised power generation sources. As a result, innovation and investment are needed to modernise the grid to support a growing share of renewables.

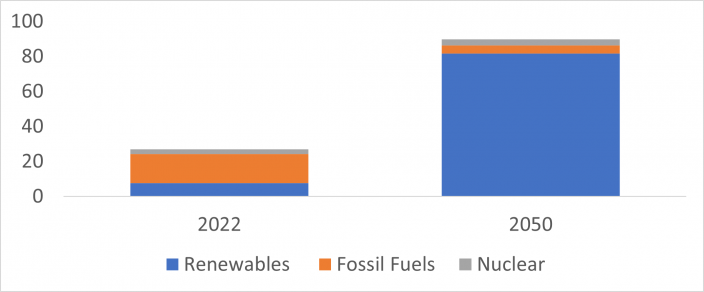

Figure 1: Power generation (PWh) needs to triple, with a significant shift to renewables by 2050.2

Alongside this challenge, end-use electrification (of transport and heating for example) also increases the demand burden, meaning grid expansion will also be necessary alongside modernisation. On the positive side, increased deployment of digitalisation and “smart technology” can enable more flexible demand. For example, smart meters can signal to consumers when it’s cheapest to use electricity.

We think these challenges are underestimated, but we also see opportunities which are under-appreciated.

When does the sun shine?

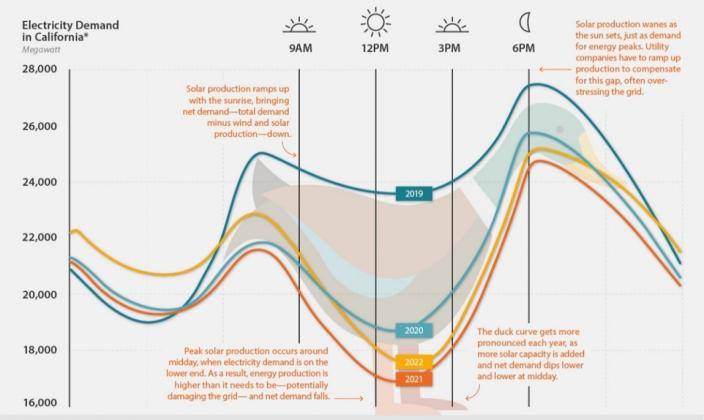

Peak solar production typically occurs around midday. But when do the lights get turned on? Demand for electricity peaks just as the sun goes down. The diagram below illustrates this mismatch between supply and demand. Known as the ‘duck curve’, the mismatch grows as we use more solar energy.

Figure 2: The solar power ‘duck curve’.3

But these fluctuations aren’t just daily. Seasons cause mismatches across months; weather patterns like El Nino across years; and major weather events can create sudden, short-term changes. All of these factors are also becoming increasingly unpredictable due to the effects of climate change.

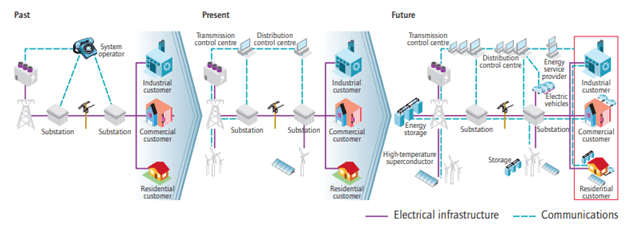

The variability in power generation creates significant challenges for the grid. The diagram below gives an indication of some of the technology that can support a more flexible grid.

Figure 3: Smarter electricity systems.4

At WHEB, we are already investing in some of the solutions. The examples you can find in our portfolios include: smart grid technology, battery storage solutions, Electric Vehicle (EV) charging and semiconductor technology that enables communication between the different parts of the system.

What makes a grid smart?

A smart grid is all about information and control. It is fitted with information and communications technologies (ICTs) to enable a real-time, two-way communication between suppliers and consumers. This creates a more dynamic interaction on energy flow, which helps to deliver electricity more efficiently and sustainably. According to the International Energy Agency (IEA), investment in smart grids needs to double by 2030 to get on track with Net Zero Emissions by 2050.5

Not a case of plug and play

But doubling investment in grid infrastructure isn’t easy. It’s an area that is heavily influenced by policy and regulation. Planning and approval can take years, delays are common and it’s not an industry known for its innovative flair.

Grids globally are already struggling to cope with the addition of renewable power. In the UK, projects are being connected to the grid on average four years after the date requested.6 In the US, fewer than one in five solar and wind proposals actually make it through the interconnection queue as developers eventually just give up.7

How is WHEB positioned?

In the WHEB global strategy we invest in several companies with exposure to smart grid technologies. Silicon Labs is a leading supplier of semiconductor technology that enables wireless communication and the internet of things.

Figure 4: Silicon Labs and the internet of things (IoT).8

The connectivity they provide in smart meters, EV chargers and solar panels is a key enabler of communication with the grid. That in turn enables better visibility, and potentially management, of end-demand.

Other examples include Infineon, which makes power semiconductors designed for flexible grid transmission and high voltage power transmission. TE Connectivity, a world leader in connectivity and sensors, also recently acquired a German company leading in power grid monitoring, protection and automation systems.

A more direct example can be found in WHEB’s European strategy. Alfen is a company with a portfolio of smart grid products including transformer substations, micro grids and solutions to connect and manage grid assets. It also produces EV chargers and energy storage products which further contribute to flexibility of the grid.

The role of storage

The grid is becoming more complicated. As well as utility-scale power there will be new small-scale and local renewable sources including residential solar. Battery storage and EVs are also now being designed to work in reverse as a source of supply, as well as being a user of electricity from the grid.

Storage solutions play a crucial role in flexibility. Industrial scale storage technology, which is the type that Alfen provides, serves multiple purposes. It can provide back-up and temporary power but can also be used for load balancing. This is the process of matching peak demand with additional sources of supply, or peak supply with storage. In the last quarter, Alfen’s energy storage segment grew almost 600% - clearly an exciting growth opportunity for the company.

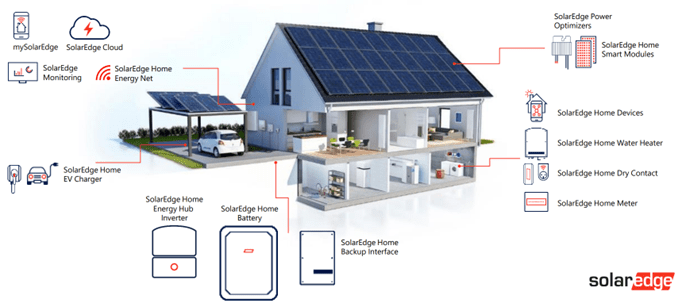

The same is true of residential storage. SolarEdge, held in our global strategy, is seeing strong growth in its storage solutions, which connect to its solar panel technology and smart energy ecosystem within the home. That in turn connects with utilities and the wider grid to allow for better visibility and control across the system.

Figure 5: SolarEdge products in residential homes.9

Making grids a strategic priority

The technology solutions to the challenges the grid faces already exist. The task now is to integrate them into existing infrastructure and accelerate the planning and delivery of grid expansion. That will require political will and significant spending, which is not easy in the current environment.

This is particularly pertinent as increasing investment could end up being passed on to consumers through electricity bills, if policy makers don’t adapt the traditional mechanism for adding grid investment costs to the price of electricity. Solving the grid challenge will undoubtedly have societal benefits, but it is important to consider the immediate costs and ensure the burden is distributed fairly.

Sign up here to receive our monthly and quarterly commentaries in your inbox.

1 IRENA, “Global Energy Transformation: a Roadmap to 2050”

2 Ibid

3 Visual Capitalist, The Solar Power Duck Curve Explained

4 International Energy Agency, Technology Roadmap: Smart Grids

5 IEA, Smart Grids

6 The Economist, Adding capacity to the electricity grid is not a simple task

7 New York Times, The US has billions for wind and solar projects. Good luck plugging them in

8 Silicon Lab Investor Day 2022

9 SolarEdge Technologies, Investor Presentation