There has been a lot of doom and gloom in the media about the prospects for battery electric vehicle (EV) growth1 and adoption 2 this year. After the euphoria of the prior few years, what happened? Are EVs really on a long-term slow burner now?

The good times

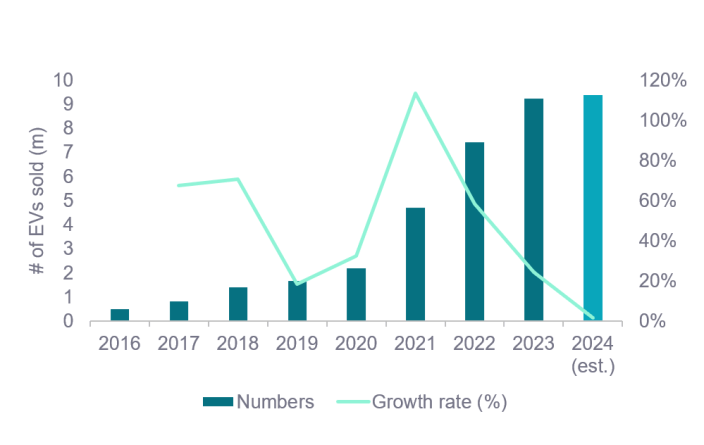

Let’s take a step back and look back at the good times. Figure 1 shows the annual global EV sales as well as the growth rates. Very healthy albeit declining growth rates until this year. Ooops.

Figure 1: Number of EVs sold by year and annual growth rate

There were several important reasons behind the rapid growth in past years. The most important one was subsidies. This should not be surprising. Again and again, we see that temporary subsidies are a fantastic tool to kickstart a newer technology and move it down the cost curve quickly via scale. Solar PV is a prominent example of this. Back to EVs, several countries had put generous subsidies in place to work towards their net zero carbon commitments, triggering healthy demand. Examples where we saw particularly strong growth were Norway (an early mover and the poster child), China, and Germany. This went hand in hand with headline-grabbing announcements from cities and countries about the phase-out or banning of internal combustion engine (ICE) cars sending strong warning signals to the automotive industry.3

A second important basis for EV adoption was the spiking of energy and fuel prices following Russia’s invasion of Ukraine. Some EVs were suddenly cheaper than ICE cars! There were a lot of smirking faces among EV owners around that time. The author’s brother being one of them.

A third reason behind the strong growth numbers was that the EV market was still largely driven by early adopters for whom the environmental benefit and owning the latest tech outweighed the often still higher cost of an EV vs its ICE equivalent.

What happened?

The EV boom slowed down during 2023 and almost completely evaporated. With the bearish commentary now dominant, what has caused the rapid slowing in growth in just two years? There are good reasons for the current hiatus:

- Firstly, and most importantly, while the total cost of ownership of an EV is usually lower than an ICE car, the upfront costs tend still to be more expensive. The withdrawal of government subsidies, most prominently in Germany and China, has exacerbated this price difference.

- At the same time, price has become much more important for two reasons. Firstly, early adopters have now, for the most part, already purchased an EV. Further growth now requires the more price-conscious mass market to buy EVs. However, the cost-of-living crisis has made this group even more price-sensitive. The withdrawal of government subsidies further eroded this group’s appetite to buy EVs.

- There are technical concerns as well. A perceived lack of charging infrastructure and still slow charging times do not help. Tesla firing its entire supercharger team in April 2024 also did not improve market sentiment. Safety too has been an issue in some markets with South Korea at the forefront where the word “EV phobia” made it into local media.4

- Car manufacturers (OEMs) ranging from GM, Ford, Mercedes, and VW to Jaguar and Aston Martin have stepped back from prior EV expansion commitments pushing them out into the future as their balance sheets were already stretched from years of poor overall car sales and growing EV inventories.5

- Finally, the EU is imposing hefty tariffs on Chinese EV imports due to ‘unfair Chinese subsidies’ on 4 October 2024 – a move which had been in the making for over a year.6

What next?

This is a sobering list of headwinds, but nothing goes up in a straight line. The question is, where do we go from here? We see good reasons to assume that 2024 will be the low point and healthy EV unit growth should resume gradually.

For example, the cost of living crisis is abating with energy prices having moved well off-peak, inflation dropping back towards normal levels and interest rates coming back down. This should all help to get a steady improvement in consumer confidence.

Some EV subsidies are actually about to re-appear. For example, Germany which removed subsidies abruptly at the end of 2023 decided in September to introduce tax relief measures for EVs.7 In addition, EV prices are coming down. Tesla made headlines earlier in the year by reducing prices on several occasions. But others will have to follow in order to re-ignite demand and avoid costly fines due to missing fleet emission targets.

And this brings me neatly to regulation which continues to tighten. On 1 July 2025, Euro 7 will come into force in the EU mandating reduced overall particle emission numbers from vehicles. In the US, Joe Biden re-instated the annual fleet-wide emission targets which tighten the screw every year. Although slightly watered down in March’24, they still set a clear pathway to an eventually mostly EV-based car fleet. Some individual States have even tougher standards with California at the forefront.8 And the new Labour government in the UK is considering reinstating the 2030 deadline for an ICE ban which had been pushed out to 2035 by the previous government.9

The only way OEMs will be able to avoid paying hefty fines is by incentivising consumers to opt increasingly for low/zero emission vehicles through price. Annually declining battery prices help. And all the OEM’s individual phase-out commitment to end ICE production remain firmly in place.

It is correct that the EV charging infrastructure requires ample investment in most countries which adds to the (often unfounded) range anxiety of prospective EV owners. The good news is that there is a lot of activity importantly from a regulatory perspective (eg the EU) for both the rollout of home and public charging points. In 2023, the public charging stock of fast chargers increased by 55% making up over 35% of public charging points at year end. 10 And also here, technology is not standing still either. Charging speed is a key adoption hindrance but solutions are in the making.11 For example, StoreDot demonstrated on a Polestar 5 their extreme fast charging (XFC) solution, cutting a 10% to 80% battery charge to just 10 minutes.12

Lastly, even theory is on the side of a more rapid EV adoption. The much quoted “S curve of adoption” introduced by Everett Rogers in his 1962 book “Diffusion of Innovations” seemed to show that for EVs the tipping point for mass adoption is around the 5% level of the sales mix which has been surpassed by more than 31 countries.13

Our position

So, how does WHEB position itself in the EV space? Our strategy has ample exposure to the electrification of transport via eight names, even though we stayed clear of pure-plays and reduced our exposure before the EV headwinds materialised. Portfolio stocks with EV revenue streams include Aptiv (vehicle electrification systems), ATS (EV battery assembly and test automation solutions), Infineon (chips / Integrated boards for EVs / EV batteries), and TE Connectivity (high-voltage connectivity solutions) to name a few.

EV sales have clearly hit a few bumps in the road, but our long-term conviction remains unshaken - the future of driving is electric.

Sign up here to receive our monthly and quarterly commentaries in your inbox.

1 FT 10 April 2024 “The electric vehicle revolution is running out of steam”. https://www.ft.com/content/11b02a4f-1604-46e3-b61f-00d39bd4cb76

2 FT 6 Sept 2024 “For European carmakers, EVs are a Catch-22”. https://www.ft.com/content/b475f111-68ce-476f-b774-a53a9ac4c967

3 https://en.wikipedia.org/wiki/Phase-out_of_fossil_fuel_vehicles

4 https://www.bloomberg.com/news/articles/2024-09-22/a-mercedes-benz-fire-may-cloud-korea-s-ev-transition-hyperdrive

5 https://www.cnbc.com/2024/03/13/ev-euphoria-is-dead-automakers-trumpet-consumer-choice-in-us.html

6 https://www.reuters.com/business/autos-transportation/eu-governments-face-pivotal-vote-chinese-ev-tariffs-2024-10-04/

7 https://www.reuters.com/business/autos-transportation/german-cabinet-agrees-proposals-tax-relief-evs-source-says-2024-09-04/

8 https://ww2.arb.ca.gov/our-work/programs/low-emission-vehicle-program/about

9 https://www.electriccarscheme.com/blog/labour-to-reinstate-2030-ice-car-ban

10 https://www.iea.org/reports/global-ev-outlook-2024/trends-in-electric-vehicle-charging

11 https://www.avnet.com/wps/portal/us/resources/article/future-of-ev-charging

12 https://www.store-dot.com/press/storedot-and-polestar-showcase-worlds-first-electric-vehicle-10-minute-charge-with-si-dominant-cells

13 https://www.bloomberg.com/news/articles/2024-03-28/electric-cars-pass-adoption-tipping-point-in-31-countries