Dear Members of the UK Wealth Managers on Climate,

Thank you for your letter of the 4th November setting out your net zero carbon (NZC) related expectations for asset managers. We whole-heartedly support your ambition in this regard. We believe that it is critical that asset managers continue to increase the pressure that they can have on investee businesses and other assets to accelerate the pace of carbon reductions and to report transparently on the work that they are doing.

Our ambition at WHEB is to be a leader on this agenda – both in the work we do to accelerate the transition to a zero carbon and more sustainable economy and in reporting on this transparently to clients and other stakeholders.

We’ve set out our approach below to the points that you raise in your letter following the same structure that you have used. We also provide extensive references to further materials that are available on our website.

I hope that this answers your questions and meets the high ambition that you have for your asset managers.

Improve ambition

Net zero commitment

Since 2019 WHEB has a formal commitment to achieve the goal of NZC emissions by 2050 at the latest1,2. This commitment applies to 100% of the assets we hold in WHEB investment strategies. We were also a founder member of the Net Zero Asset Managers Initiative (NZAMI) which was launched in December 2020.

Our commitment includes interim targets covering scopes 1 and 2 emissions and, to the extent possible, material portfolio scope 3 emissions. We also commit to working with clients and to undertake stewardship and engagement with investee companies and with policy makers and other market participants to promote achievement of NZC emissions by 2050.

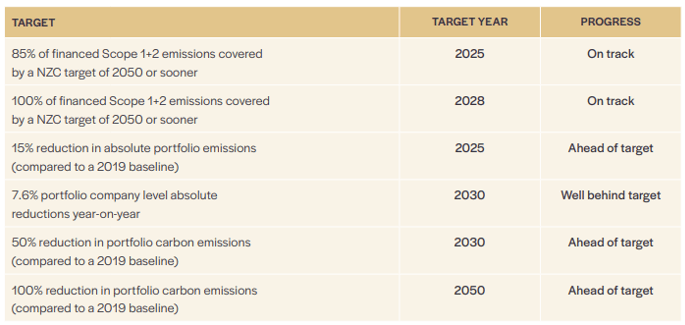

Our specific NZC targets include:

- 85% of financed scope 1+2 emissions covered by a NZC target of 2050 or sooner (target year 2025).

- 100% of financed scope 1+2 emissions covered by a NZC target of 2050 or sooner (target year 2028).

- 15% reduction in absolute portfolio emissions compared to a 2019 baseline (target year 2025).

- 7.6% portfolio company level absolute reductions year-on-year (target year 2030).

- 50% reduction in portfolio company emissions by 2030 (target year 2030).

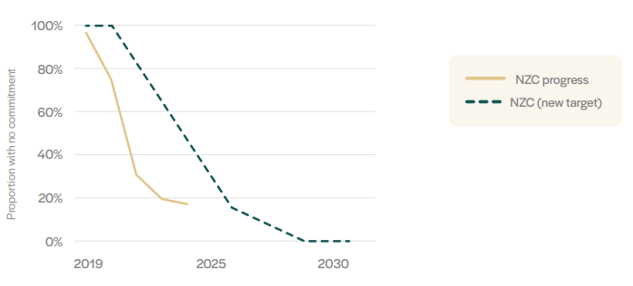

Changes to targets

We also point out that we have updated the first target listed above. The original target was that by 2025, 50% of portfolio holdings would have set a NZC target for 2050 or earlier and that by 2030 100% of the portfolio holdings would have set such a target. We met this target three years early as by the end of 2022, 54% of portfolio holdings had already set such a target. We therefore replaced this target with a more ambitious target for 2025 and 2028 as described above.

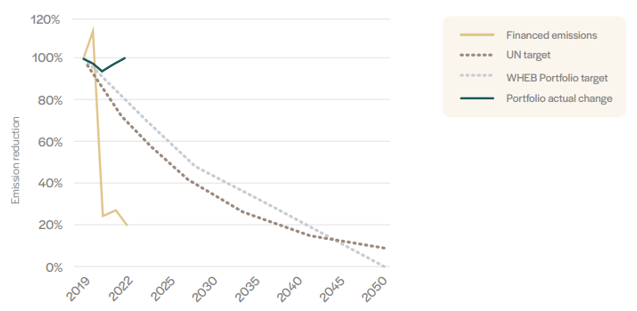

Absolute emission reductions

In addition to securing specific NZC commitments from investee companies, we have also set an absolute carbon emissions reduction target for 2030. The target is to achieve absolute carbon reductions from portfolio companies that are consistent with the 50% global reduction in carbon emissions that is considered necessary to achieve global NZC emissions by 2050.

We will differentiate between portfolio emission reductions achieved through divestment of high emitting companies (‘portfolio composition’), and actual real-world year-on-year reductions accomplished by those portfolio companies still held in the portfolio (‘portfolio company decarbonisation’). By 2025 we are hoping to achieve a 15% reduction in the absolute portfolio emissions when compared to a 2019 baseline. Even more ambitious is our target for portfolio companies to reduce their absolute carbon emissions by 7.6% each year to 2030. This level of reduction is what is needed to limit global warming to the 1.5°C goal of the Paris Agreement.

Build action

Integration into fund management

WHEB’s investment team is led by Ted Franks, Head of Investment and Fund Manager. Ted sits on the company’s Senior Management Team and was directly involved in agreeing the NZC targets set out above. The rest of the investment team are also regularly involved in engagement and stewardship activities aimed at achieving these targets3. Performance against the targets is published annually in WHEB’s impact report (see below) and this is one element in how the performance of the strategy (as well as individual sub-funds) is assessed.

Reporting of progress on NZC targets

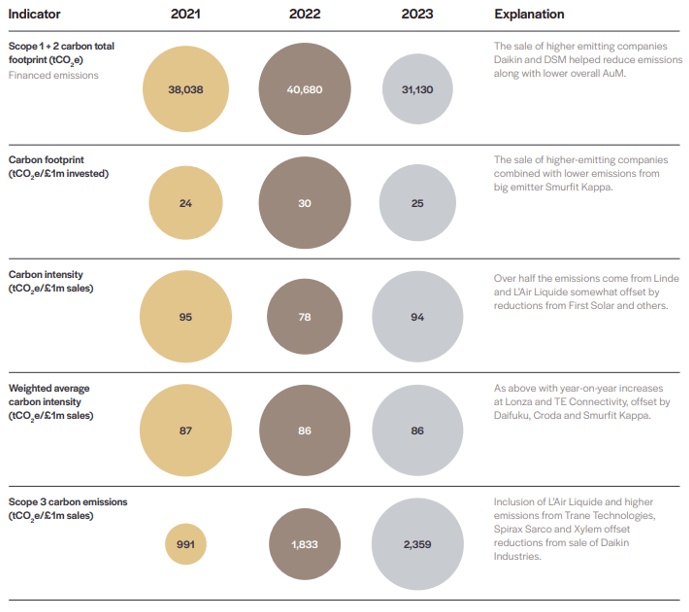

WHEB’s annual impact report contains a comprehensive set of carbon data that allows clients to assess our progress against our targets. We have been providing this data since 2019. The charts below illustrate the key metrics that we report against in terms of scope 1-3 emissions covering the WHEB strategy as a whole.

GHG emissions for WHEB’s investment strategy 2021-2023

WHEB strategy NZC targets

WHEB strategy emission targets and reductions

Progress against WHEB’s GHG reduction targets

Additional data

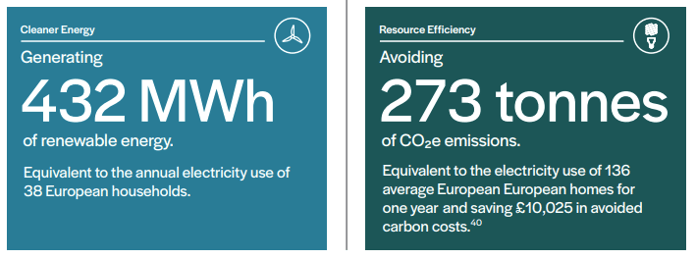

In addition to the reporting that we provide on scope 1-3 emissions from portfolio businesses, we also provide detailed data on the positive impact of holdings in the portfolio in terms of their contribution to carbon reductions and ‘avoided carbon4’. As an investment strategy that is focused on investing in companies providing solutions to sustainability challenges such as climate change, we believe that measuring and reporting on the avoided carbon associated with our investments is a critical element alongside the data on scopes 1-3 emissions (see below).

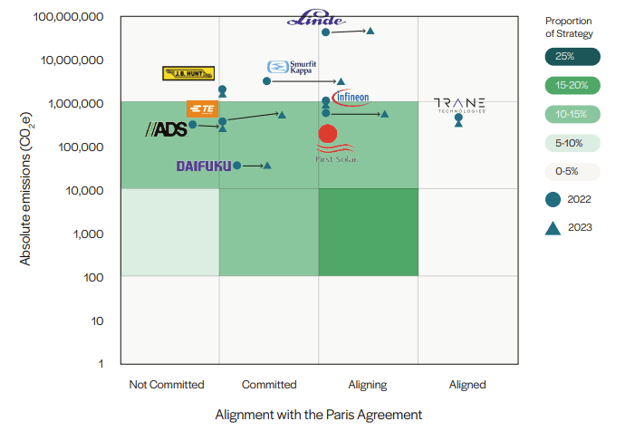

We also plan in future reports to provide more detailed data using the Net Zero Investment Framework (NZIF). This will include information on the proportion of the strategy that we consider to be ‘Committed’, ‘Aligning’ and ‘Aligned’ with the NZIF framework.

Renewable energy generated and avoided carbon emissions associated with a £1m investment in WHEB’s investment strategy in 2023

Increase influence

Collaborative initiatives

WHEB is a member of several collaborative initiatives on climate change. As previously stated, we were a founding member of NZAMI in December 2020. We have been a member of the Institutional Investors Group on Climate Change (IIGCC) since 2012 and also contribute to Climate Action 100+, and the Net Zero Engagement Initiative. For example, we are currently involved in collaborative engagement with five companies in our strategy through the Net Zero Engagement Initiative.

We have also contributed to the development of avoided emissions measurement frameworks. We published an interview in our 2022 Impact Report to publicise the importance of this metric and the methodological challenges in calculating it5. In our 2023 report we published another interview with a group of portfolio businesses on their approach to reporting positive impact including of avoided emissions6. We also are engaging with a number of data providers, and with our investee companies, to encourage more rigorous and standardised measurement of avoided emissions.

Bilateral engagement and engagement outcomes

In addition, all of our portfolio holdings are subject to our NZC policies. Very few (if any) of our portfolio holdings are subject to shareholder resolutions on climate and consequently we utilise routine votes to set out our views on the need for Paris-aligned climate strategies and NZC targets and commitments. In 2023 we voted against 17 management resolutions across 12 company AGMs due to inadequate carbon reduction targets or incomplete strategies to address climate change. In each case we have written to the company to make it clear why we had voted against management.

In our 2023 Impact Report we started to report on the progress that the largest emitters in our portfolio are making in aligning their climate strategies with the Paris Agreement and in reducing their scope 1 and 2 GHG emissions. We plan to update this annually. We also publish more detailed case studies of engagement activities and outcomes for some of these companies.

Mapping outcomes of WHEB’s portfolio GHG emissions

I hope this answers your questions. Do let us know if you would like more data or would like a follow-up call.

With best wishes,

Seb Beloe

Partner, Head of Research

WHEB Asset Management

1 https://www.whebgroup.com/assets/files/uploads/20230424-nzc-policy-portfolio-emissions-final.pdf

2 We’ve also set out our policy for achieving net zero carbon emissions from our own operations https://www.whebgroup.com/assets/files/uploads/20240521-nzc-policy-operational-emissions-final.pdf

3 More details on our engagement work on NZC is available on our website at https://www.whebgroup.com/investing-for-impact/stewardship/engagement-case-studies

4 Also known as ‘scope 4 emissions’.

5 https://www.whebgroup.com/assets/files/uploads/wheb-impact-report-2022.pdf

6 https://www.whebgroup.com/assets/files/uploads/wheb-impact-report-2023-spreads-v2.pdf