Hindsight is 2020

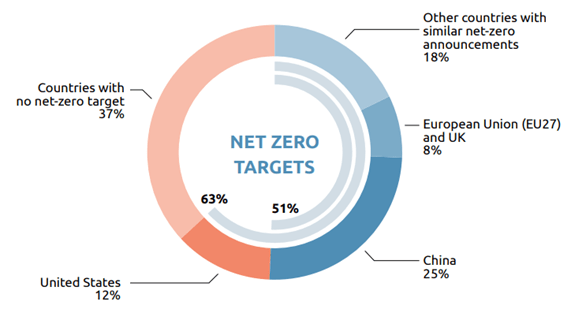

2020 was a monumental year on just about every level. It was a year that challenged us to reconsider almost all our prior assumptions. Even more remarkable therefore, that climate change remained a persistent issue on investors’ agendas through the year. It was not just the hellacious wildfires, the overactive Atlantic hurricane season, or the grinding increases in global temperatures. 2020 also witnessed a series of remarkable commitments from governments, companies, and communities around the world. By year end, over 50% of the global economy had made in principle commitments to being net zero by 2060 at the latest . With President-elect Biden expected to add the US to this list, the proportion of the global economy committed to net zero emissions will reach nearly two thirds.

COP 26 – a critical milestone

As important as 2020 was, 2021 is shaping up to be even more pivotal. The 2015 Paris Agreement requires signatories to revisit their national greenhouse gas (GHG) reduction targets every five years. Many did not achieve this in 2020 due to the COVID-19 pandemic. These commitments, and those that are still expected, will need to be legislated and submitted to the UN secretariat of the Framework Convention on Climate Change. Energetic support from the incoming US administration should help to ensure that these commitments are ambitious. It is not an understatement to say that the scale of these commitments will determine whether or not the planet has any realistic chance of avoiding warming of more than two degrees.

Will we ‘build back better’?

After the COVID-induced disruptions of 2020 and early 2021, the shape of the economic recovery will also become apparent in 2021. Most investors seem to be anticipating a relatively rapid snap-back. Some analysts anticipate an almost historic rally in industrial markets.1 In their view, we can expect a coincident reflation in both short-cycle inventories and long-cycle capital expenditure. The recovery is expected to include autos, trucks, housing as well as general capital expenditure. Given the long horizon of many of these investments, it is clearly critical that this expenditure is aligned with the zero carbon commitments that many countries are making.

We are reasonably optimistic that a good proportion of this capital will be deployed into lower carbon infrastructure and technologies. For one thing, 2021 will almost certainly see an acceleration in the shift towards electric vehicles (EVs). EVs already accounted for more than 10% of all new vehicle sales in the EU by the end of 2020. With a growing range of models and price-points they could account for as much as 15% in 2021. Globally, passenger EV sales are expected to grow by nearly 60% this year to 4.4 million.2

Other trends that we expect to accelerate in 2021 will be further investment in factory automation. The global market for industrial robotics is expected to grow by nearly two thirds in the next five years.3 Demand will be driven primarily as a response to the COVID-19 pandemic but with the parallel benefit of improved energy efficiencies. We also expect to see economic stimulus packages that seek to reflate the economy by encouraging the recapitalization of key sectors with low and zero carbon technologies. These sectors will likely include buildings, transportation and utilities.

These trends were all readily visible in 2020. They need to accelerate in 2021. We think they will.

Beyond climate and COVID

Alongside climate change we also believe of course that the response to the COVID-19 pandemic will remain central in 2021. However, there are other topics that we think will gain in importance during the year.

The pandemic has laid bare many of the underlying inequalities in societies around the world. We expect this, combined with a greater awareness on racial inequality, to result in a more acute focus on the role of companies in addressing inequality. Ensuring that vulnerable and disadvantaged communities are not left behind will be an important part of the ‘ESG’ agenda in 2021. Businesses that are seen to be exploiting these groups will be quickly censured.4

The collapse in biodiversity in almost all regions of the world will continue to garner growing attention from policy-makers, in our view. We expect the same to be true of the circular-economy. In both areas we anticipate the emergence of new technologies and business models that more directly and fully address these challenges in 2021. Most will still be too small and experimental to represent major investment themes for us. But these are both areas of critical importance to sustainability and we will continue to actively explore them within the WHEB investment strategy.

1 Liberum, Capital Goods – Sector Upgrade: Industrial earnings boom ahead, 8 December 2020

2 Bloomberg New Energy Finance

4 Already in January in the UK we have seen Compass Group suffer severe criticism for its involvement in inadequate food parcels for poor households (https://www.ft.com/content/2162181a-be67-4feb-a5a8-ae63e3e05fce)