Clean and efficient energy is our greatest weapon against Russian autocracy

Russia’s invasion of Ukraine has been met with an unprecedented display of economic force. Russian assets have been frozen, preventing $630bn of foreign currency reserves from being used to fund its war machine1. Russian banks have been blocked from the international finance system SWIFT, paralysing the country’s ability to conduct international trade. Russian individuals and businesses have been hit with asset freezes and other sanctions to choke support for Putin’s war.

In the short-term, these are powerful tools to ‘fight’ the war in Ukraine (without actually fighting the war in Ukraine). But over the long term, the greatest lever we have against runaway Russian power may be to weaponise power itself.

Fossil fuels are Russia’s largest source of income

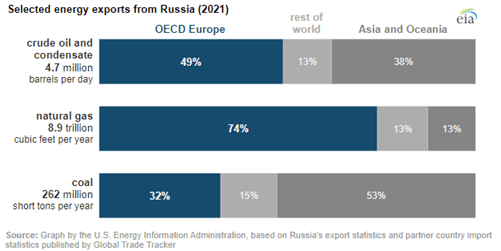

Combined, Russia is the largest net exporter of oil and gas in the world, earning $241 billion in 20212. Europe is its biggest customer, buying nearly half of Russia’s oil and three quarters of its natural gas exports last year, as shown in the chart below3. Historically, fossil fuels have accounted for as much as 63% of Russia’s exports and a third of its federal budget4. This cash has helped fund the military force that is currently destroying Ukraine.

European energy security is hanging in the balance

Aware that Russia’s economy is propped up by its fossil fuel exports, America has already banned imports of Russian oil and gas. But, given the implications to its own economy and citizens, Europe has been unable to do the same. Germany is particularly reliant on Russian energy imports – IMK, a think tank, has argued that halting Russian energy imports would cause a deep recession in Germany5.

Nonetheless, European citizens are still paying a high price for its reliance on imported fossil fuels. 35% higher, to be precise, as the invasion of Ukraine adds fuel to the fire of an already deepening energy crisis6. Clean and sustainable energy has always been an environmental priority for the EU. Now it is a political one as well.

Steps towards energy independence

In March, the European Commission unveiled RePower EU, a new policy initiative which aims to achieve independence from Russian energy by 2030. The plan includes:

- More rooftop solar panels, heat pumps, and energy saving technologies,

- Decarbonising industry by accelerating electrification,

- Accelerating the development of green hydrogen infrastructure, and

- Speeding up renewables permitting.

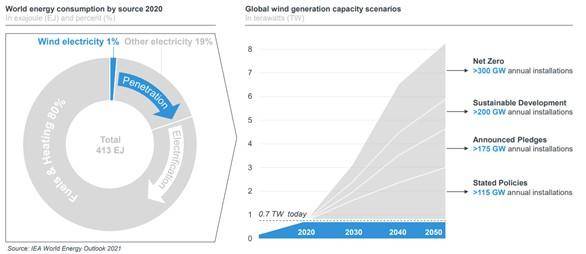

These are all important initiatives, but that last one is critical. The permitting process in the EU is slow and over-complicated. In fact, it is the number one constraining factor on European wind development. As the CEO of Vestas Wind Systems complained to us last month – ‘It’s not lack of capital, we just need to get permitting going’. If Europe can fix this issue, it may finally be able to deliver on its pledge to install 451GW of wind capacity by 2030[7] – implying a huge acceleration compared to the current rate of expansion. As the following chart shows, the world dearly needs a much faster rate of wind capacity expansion to reach Net Zero by 2050:

The EU might opt to follow the lead of the UK, which recently announced plans to double the frequency of renewable energy tenders to accelerate new capacity build8. This comes as the UK releases its new ‘Energy Security Strategy’, which aims to ‘supercharge cheap renewables’ although, controversially, this strategy also includes new nuclear capacity while excluding onshore wind9.

America First ensures Cleaner Energy policy remains on the agenda

America may not be as reliant on imported energy as its European allies, but that doesn’t mean energy security is not a priority. President Biden’s State of the Union address, delivered in March, pledged to ‘transform America’ and ‘win the economic competition of the 21st Century’. The President described a battlefield between democracy and autocracy which America must win – ‘and we’ll do it all to withstand the devastating effects of the climate crisis’.

In our last quarterly review we told you that the Build Back Better plan containing more than $500 billion in climate-related spending had failed to pass through Congress. But from its ashes, we may yet see American policy action throwing support behind the climate transition.

The business leaders, brokers, and consultants we speak to typically believe the >$500bn in Clean Energy spending from Build Back Better is still alive – but remains subject to the interference of Senator Joe Manchin. In March, the Senator pledged his support for an ‘all of the above’ energy bill which would include big clean energy investments, but only if domestic oil, gas and coal production are still on the cards10.

On a smaller scale, the America COMPETES Act, already passed by the House of Representatives, contains $3 billion for the domestic manufacturing of solar energy11. If passed by the Senate, we believe this would benefit our investment in American solar module manufacturer First Solar.

Meanwhile, the President has just announced several initiatives aimed at ‘achieving real American energy independence’12. These include a further $3 billion in funding for household efficiency and electrification upgrades, and new smart standards focused on more efficient home appliances and equipment. Initiatives like these, principally focused on consumers and homeowners, may benefit our holdings in SolarEdge (given its strong presence in residential solar, illustrated in the diagram below), and Power Integrations (which manufacturers energy efficient semiconductors).

A new era for energy policy?

The Biden administration tried and failed to pass big Cleaner Energy policies last year. Their mistake was to appeal to ideals of environmental justice and climate resilience that are simply not strong enough in America, the world’s largest oil producer. So they are changing the narrative. American Cleaner Energy policy is now being framed as a battle between democracy and autocracy, in which America must compete to win.

Europe has always had big ambitions for environmental policy. The EU has so far failed to build capacity at a fast enough rate to meet its commitments, however. That looks set to change now. Europe’s reliance on Russian power weakens its ability to respond to acts of atrocity and leaves its own energy security hanging in the balance. Europe can no longer afford to drag its feet.

Russia’s huge military and its invasion of Ukraine is largely funded by its fossil fuel exports. Ending the West’s reliance on Russia through investments in clean and efficient energy is, therefore, the surest way to constrain Russian military power and destabilise its autocratic regime for years to come.

1 https://www.ft.com/content/526ea75b-5b45-48d8-936d-dcc3cec102d8

2 https://www.reuters.com/markets/europe/russias-oil-gas-revenue-windfall-2022-01-21/

3 https://www.eia.gov/todayinenergy/detail.php?id=51618

4 https://www.oecd-ilibrary.org/sites/23fe599b-en/index.html?itemId=/content/component/23fe599b-en

5 https://www.economist.com/europe/can-germany-cope-without-russian-gas/21808482

6 Difference in consumer energy prices (HICP) between December 2020 and February 2022. Source: https://ec.europa.eu/eurostat/databrowser/bookmark/1d136cf7-7391-462e-a1f0-466487db9b06?lang=en

8 https://www.windpowermonthly.com/article/1739777/uk-plans-annual-cfd-tender-rounds-wind-renewables

9 https://www.gov.uk/government/speeches/delivering-great-britains-energy-security

10 https://www.politico.com/news/2022/03/02/joe-manchin-democrat-bill-taxes-00013246