WHEB’s core intention is to invest in companies that are proving solutions to sustainability challenges. In addition to the positive impact that these companies have through their products and services, it is also essential that the emissions generated in the manufacture and provision of those products and services are reduced in line with a 1.5°C limit of global warming. Below we give an update on the progress our portfolio companies have made at setting net-zero targets and reducing emissions, as well as the progress WHEB has made at decreasing emissions within our own operations.

Over half of WHEB’s portfolio is committed to net-zero carbon emissions

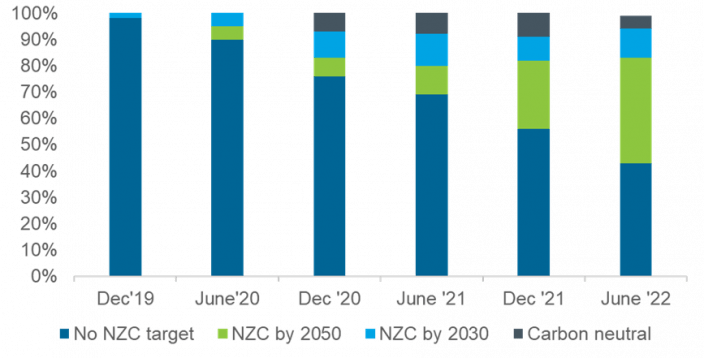

As a signatory to the Net-Zero Asset Managers Initiative, WHEB is committed to ensuring that, by 2030, 100% of our portfolio have set net-zero carbon (NZC) targets and are able to demonstrate alignment with a trajectory towards 1.5°C limit of global warming. At the end of 2020, 10% of our portfolio had committed to being NZC by 2030 with a further 14% committed to net-zero by 2050. Over the course of 2021 and the first half of 2022 we’ve seen several changes to the portfolio. In early 2021 we sold Kingspan, a supplier of materials and solutions that reduce energy consumption in residential and commercial buildings, which had committed to NZC by 2030. This reduction was offset in early 2022 when we bought Spirax-Sarco, an engineering firm focusing on increasing energy efficiency within industrial processes, which has an equally stringent target. This has led to a small increase to 11% of the portfolio committed to NZC by 2030. Much more significant though has been the dramatic growth from 14% to 40% in the proportion of the portfolio committed to NZC by 2050. Consequently, WHEB has achieved our interim target of having at least 50% of the portfolio committed to achieving NZC emissions by 2050 at the latest. We had hoped to achieve this by 2025 and so have met this target three years early.

Of the 51% of the portfolio committed to achieving NZC by 2050 at the latest, 85% are either in the process of being– or have already been – approved by the Science Based Targets initiative (SBTi). Of the top five emitters in WHEB’s portfolio (making up 77% of the total financed emissions), four have committed or had targets approved by the SBTi. This is a key area of focus for WHEB’s engagement strategy, with over 16% of our portfolio engagement in 2021 specifically focused on the setting of NZC targets.

Delivering reductions in carbon emissions in the real world

However, the reporting of emissions and the setting of targets is not sufficient to see real-world carbon reductions, it is essential that emissions are actually reduced. At the portfolio level, our financed emissions have decreased dramatically year over year, largely due to the divestment of China Everbright Environment Group, whose main business focuses on waste-to energy. However, there were a number of companies in the fund that did deliver real world carbon emission reductions in their scope 1 and 2 emissions. Of our portfolio companies, 60% reduced their total absolute emissions between 2020 and 2021, with almost 50% achieving a downward trend of total emissions over the past 5 years. Some significant reductions came from Silicon Labs, a semi-conductor and electrical component manufacturer, who have reduced their scope 1 and 2 emissions by 29% since 2018, and Vestas, the world’s largest manufacturer of wind turbines, which has managed a 22% reduction in scope 1 and 2 emissions since 2017. Clearly, to limit global warming we need to see absolute reductions in emissions across all the portfolio, and the economy in general.

WHEB’s operational emissions

In 2021 we completed the first full estimation of all relevant scope 3 emissions (purchased goods and services, business travel, waste generated in operations, employee commuting). The emissions associated with business travel have been monitored since 2017, and the effect of the pandemic can be clearly seen with a 94% reduction in business travel emissions in 2021 when compared with our 2019 base year. As we begin to travel to see more clients and investee companies, we expect this figure to increase, however we remain focused on reducing this figure to meet our 2025 net-zero carbon target for our operational emissions. One example of this is WHEB’s travel policy that requires employees to take the train when travelling for business for any journey that is under 6 hours.

The shift to working from home has caused the employee commuting category, which includes emissions associated with home working, to be the largest contributor to our operational emissions (excluding investments). WHEB has now initiated a hybrid working model with most employees returning to the office for at least two days per week. This will reduce emissions associated with home working. These emissions were calculated using a survey sent to all employees with questions regarding their working from home habits. One result of the survey was confirmation that 88% of WHEB employees are on a “green” electricity tariff, with 22% of employees directly using renewable energy.

Pushing our suppliers to do more

WHEB’s engagement strategy is not purely focused on portfolio companies, but also extends to the suppliers of goods and services to our own operations. For new contracts and contract re-negotiations, we require that suppliers monitor and report their carbon emissions, in addition to setting targets for emission reductions. In 2022, we aim to have 60% of our suppliers setting emission reduction targets, increasing to 80% in 2023. As a B Corp, we aim to work with other B Corps wherever possible which increases our confidence that our suppliers are also committed to managing their environmental impact.

Next steps

Despite the ongoing issue of lack of available data, WHEB’s own data analysis increased in quality when estimating the positive impacts associated with our portfolio companies. The impact calculator, referenced in our annual impact report showed an increase in the quality of the data from 87% in 2020, to 94% in 2021 as assessed by the Carbon Trust. Even with this improved level of data quality, there is a long way to go before in terms of data quality. Many companies are not yet reporting emissions, particularly scope 3, and when data providers attempt to estimate emissions, the results can vary significantly. With these estimation techniques being so subjective it is essential that more companies begin to report their emissions, including what many are calling “scope 4”, the avoided CO2e that occurs with the use of more efficient or lower carbon products or services. WHEB has demonstrated our continued commitment to transparency and accountability by reporting all emissions calculated in 2021 in a CDP disclosure which will be publicly available later this year, as well as committing to have our net-zero targets approved by the SBTi.