What is there not to like about software companies? They tend to operate at high margins, benefit from astonishing operational leverage and run a negative working capital position, since customers tend to pay upfront. But are they impactful and do they solve sustainability problems?

When we see a software company like Microsoft in an impact fund we tend to roll our eyes and ask ourselves precisely that question. So, it is not unreasonable to probe our own software holdings for their impact.

Our strategies have a healthy exposure to software companies focussed on the field of simulation and computer-aided-design with ANSYS, Autodesk and Dassault Systemes (and to some degree Hexagon). These companies develop software which is used to design new products, as well as buildings and infrastructure and simulate their behaviour in real life before they are actually built.

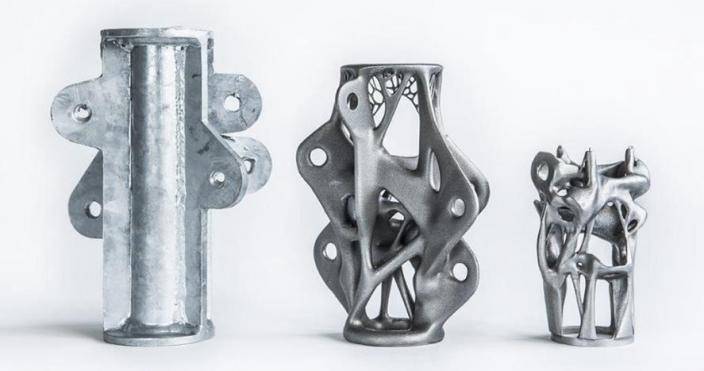

Generative design reduces material use by 75% for this structural building component1

We consider these companies as highly impactful in the battle to reduce resource waste and greenhouse (GHG) emissions. Among others, their software tools allow customers across a wide range of industries to:

a) design products that are inherently more resource and energy efficient,

b) speed up product development times,

c) reduce waste during product design, and

d) run more effective maintenance of products in use.

Let’s put some meat on the bone and provide examples which show-case their positive impact.

Designing more efficient products more quickly

ANSYS has a strong exposure to the automobile industry and especially to the transition to low carbon and autonomous driving. Their simulation solutions are used by >90% of the world’s leading automobile suppliers. In the electric vehicle (EV) development, their market-leading, multiphysics simulation solutions are used to optimise four critical technology areas of the car: 1) Electric Motors (eg efficiency, thermal management), 2) Battery & Battery Management Systems (optimisation of all aspects from electrochemistry of the battery cell to safety of the whole system), 3) Power Electronics (increase of power density and lifetime, lowering losses and thermal derating), and 4) Electric Powertrain System integration. The overall result from using simulation software is a 50% reduction in overall development time (and therefore availability of a more environmentally friendly product much more quickly) and a 12% improvement in power density and energy efficiency which translates straight to CO2 reductions.2

Reducing waste during and in the product design

Designing a new product can consume a vast amount of time and resources with building many prototypes and testing them out over and over to finally settle on a design deemed “best”. There exists an alternative to this. Autodesk used “generative design” in combination with additive manufacturing to completely redesign a traditional car seat bracket for General Motors. This was to be used in its EVs where weight is a key factor to maximise the battery range. Generative design is a combination of engineer input and computer modelling using artificial intelligence. While the engineer sets design goals and constraints (eg materials, manufacturing method, budget), the computer runs through tens of thousands of permutations to find the optimal design. The result for the car seat bracket was impressive: 40% lighter (ie 40% material savings) but 20% stronger than the old design.3

Optimising product maintenance and performance with “digital twins”

A digital twin is a virtual representation of a physical asset in operation such as a wind turbine. Sensors on the wind turbine transmit back data to the digital twin to provide real-life information of the state of the turbine. Engineers or a simulation program can then modify parameters on the digital twin to explore the effects and find the optimal setting for running the real turbine. In addition, predictive analytics on the twin is used to understand when certain parts are worn out and need replacement. This avoids unscheduled shutdowns, reduces costs and increases output.

Together with Accenture, Dassault Systemes calculated the potential savings from the use of digital twins in various industries and the benefits were found to be staggering. The report estimates a combined additional benefit of US$1.3trn in economic value and 7.5Gt CO2 emission reductions between 2021 and 2030 if it was implemented broadly.4

We hope these examples show how a certain class of software companies can indeed contribute significantly to reducing GHG emissions across many industries. And even though this article has been written with Microsoft tools, we simply cannot say the same for that company.

1 https://formlabs.com/eu/blog/generative-design/

2 ANSYS – Handprint-Use-Case-Electric-Vehicles. https://investors.ansys.com/esg/Ansys-Handprint-Use-Case-EV/default.aspx

3 https://www.autodesk.com/customer-stories/general-motors-generative-design

4 https://www.accenture.com/gb-en/insights/industry-x/virtual-twins-sustainability