Unleashing the potential of impact measurement in listed equities: The crucial role for asset managers (part 1 of 2)

Impact investing – that is 'investing that is made with the intention of generating positive, measurable social and environmental impact alongside a financial return’1– has proven popular in recent years.2 3 Much of this drive is coming from asset owners.4 5 Pension funds are being pushed by impact-focused beneficiaries. Charitable foundations that invest have impact-related missions. Individual investors want positive impact.6

Impact investing in listed equities is a relative late comer to the impact investing party. It is, however, now seen not just as possible to deliver impact by investing in listed equities, but as an area of increasingly importance to investors.7 There are strong reasons for this support. Bringing the scale and reach of listed equity markets to bear is essential in responding to crises like climate change, inequality, loss of biodiversity, and lack of human rights protections. As Sir Ronald Cohen put it ‘There is no other way to cope with the scale and severity of social and environmental issues’.8 Regulators too are now stepping in including the UK’s Financial Conduct Authority and the European Securities and Markets Authority both of which refer to impact investing in proposed regulations governing listed equity investment products.9 10

This blog aims to foster discussions on better practices of impact measurement in listed equities. It sets a foundation for impact measurement and explores initial steps that asset managers can take on their impact measurement journey. A follow-up blog will explore more ambitious steps that asset managers can pursue, shedding light on future possibilities. It is important to note that impact measurement differs by asset class. While this blog focuses on listed equities, other asset classes warrant similar conversations.

Why should we try to measure impact in listed equities?

Every investment has a range of impacts, both positive and negative. Investors, especially those who want to be sustainability leaders, should value the process of measuring this impact. Asset owners also expect asset managers to understand and measure their impact, despite the challenges of complexity, trade-offs, and limitations in what is currently possible to measure.

Impact investing still accounts for a small proportion of the total UK investing market.11 Intentional and thoughtful attempts to understand and measure impact are crucial to the sector’s much-needed growth. As we take this journey, we should adopt a spirit of learning and constant improvement in dealing with real-world problems, and not just see impact measurement as a communications tool.

The vital role of Asset Managers in Impact Measurement

Impact investing needs robust and transparent impact measurement to drive change. Without it, trust may even be undermined. The onus is now on asset managers, with the support of their asset owner clients, to unleash the potential of impact measurement. Asset managers are well positioned to measure impact as they have industry expertise, access to data, and more resources than other actors. The question arises: “Who will measure impact if not asset managers?”

Setting a foundation for measurement in impact investing

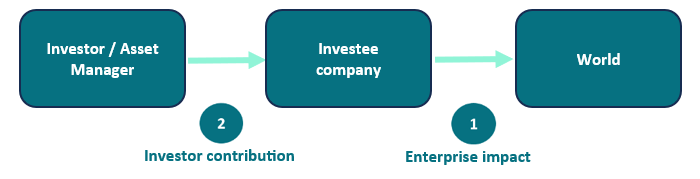

A key consideration in impact investing is to understand how impact is delivered through investment activities. In listed equities, positive impact can be generated both by the investee company and then separately, by the investor(s). The impact created by the investee company is commonly known as the enterprise impact or enterprise contribution.

Figure 1: Distinguishing between enterprise impact and investor contribution

The investor contribution has also become increasingly important. In some cases, investors deliver a positive impact by investing primary capital in the investee. In secondary markets, investors also contribute in other ways, such as by encouraging management to reinvest profits in positive impact activities or using engagement to push for improved sustainability performance. Supporting the share price is also important as a strong and stable share price can be used to incentivise employees and boost firepower for acquisitions, among other things.12 Starting from this foundation, asset managers should set out their own model of how they understand and attempt to deliver a positive impact. There are examples to follow including from WHEB13 and Snowball.14 15

Early steps toward impact measurement

Clarifying key social and/or environmental problems and what success would look like

Investors should clearly articulate the social and environmental problems they want to help solve. This can be at the level of the asset manager overall, at the fund level, and then importantly at the level of each investment. At each level, asset managers should explain how their activities connect with and solve the stated problem(s). It is crucial to clearly articulate the specific changes you want to see in the world. By doing so, a clear direction and purpose for action is provided. Montanaro Asset Management, for example, sets out “impact themes” in relation to its Better World Fund.16 Numerous internationally agreed frameworks can be drawn upon, for example the Sustainable Development Goals, IPCC CO2 reduction targets, the UN Guiding Principles for Business and Human Rights, and the ILO Core Labour Standards.

Articulating a ‘theory of change’

A 'theory of change’ is a process that has long been used in the international development and NGO sector.17 18 It can be used to help organisations think critically, learn, and adapt their work to increase impact.19 A theory of change involves developing a shared analysis of the change needed, the steps needed to achieve it, and how an organisation can contribute. Applied to investment, a theory of change can be used at the organisational, fund or individual investment level. Triodos Investment Management, for example, uses a theory of change as a management framework across its various priority areas.20 21 WHEB in contrast describe their theory of change for their investments at fund and stock level.22

Focusing on the ‘investment’ in impact investment

Impact investing is not just about impact. It is also about finding an alignment between the financial return and the impact return. The core objective is to find businesses that represent good investments because they are delivering a positive impact. In other words, the financial case for investment is firmly rooted in the impact case. Ideally, these companies will grow and sell more of their products and services to make more profits and in so doing generate more positive impact. The two objectives are clearly aligned. Investment groups like Regnan23 and EQ Investors24 have sought to emphasise this important aspect of impact investing.

In this first blog, we have laid a foundation for impact measurement and explored early steps asset managers can take on their impact measurement journey. The key takeaways are:

- Impact investing in listed equities requires that the impact be intentional and measured, with a spirit of learning at its core.

- Asset managers should be playing a crucial role in impact measurement.

- Asset managers should set a foundation for impact measurement, by clearly articulating their approach to enterprise impact and the investor contribution.

- Asset managers should clarify what success looks like on the key social and environmental problems they are addressing.

- Asset managers should set out their theory of change on how their investment activities contribute to the impact objectives that they have set.

- The goal should be to align financial and impact returns.

In the next part of this series, we will explore more ambitious steps from asset managers on impact measurement and discuss where things could go in the future.

Authors

Seb Beloe is Partner and Head of Research at WHEB Asset Management. Based in London, WHEB is a leading proponent and practitioner of impact investing in listed equities (https://www.whebgroup.com/).

Charlie Crossley is Investment Engagement Manager at Friends Provident Foundation, which has long been pushing the asset management sector to integrate real-world impacts into their investments. Charlie has a background in both responsible investment and impact measurement in the charity sector.

Further reading: Examples of impact measurement from asset managers

WHEB White Paper: “Impact investing in listed equities” https://www.whebgroup.com/news/whebs-new-white-paper-impact-investing-in-listed-equities

Snowball: An overview of the Snowball impact framework https://www.snowballimpactinvestment.com/insights/How%20we%20measure%20impact

Montanaro Better World Fund Impact report 2022 https://montanaro.co.uk/wp-content/uploads/2022-Impact-Report-Montanaro-Better-Word-Fund.pdf

Impact report 2019 | Triodos Investment Management (triodos-im.com) https://www.triodos-im.com/impact-report/2019

Webinar – Triodos Investment Management: Theory of Change: Steering tool for effective impact investing https://www.brighttalk.com/webcast/16997/361040

WHEB Annual Impact Report: Jan – Dec 2022 https://www.whebgroup.com/assets/files/uploads/wheb-impact-report-2022.pdf

Regnan: Launch of Regnan Global Equity Impact Solutions Fund https://www.johcm.com/siteuploads/news/Press%20release20Launch%20of%20Regnan%20Global%20Equity%20Impact%20Solutions%20Fund.pdf

EQ Investors: EQ Positive Impact Portfolios Positive Impact Report 2021 Launch https://eqinvestors.co.uk/wp-content/uploads/2021/10/Meeting-needs-in-emerging-markets-80%93-Positive-Impact-Report-2021-Launch-Webinar-2-80%93-Slides.pdf

Sign up here to receive our monthly and quarterly commentaries in your inbox.

References

1 https://thegiin.org/impact-investing/

2 The GIIN’s 2023 GIINsight report found that assets invested in impact strategies has grown from US$95bn in 2017 to US$213bn in 2022 https://thegiin.org/assets/documents/pub/2023- GIINsight/2023%20GIINsightE293%20Impact%20Investing%20Allocations,%20Activity%20&%20Performance.pdf

3 Impact Investing Institute Public Equity Funds https://www.impactinvest.org.uk/case-study/public-equity-funds/

4 Asset Owners Prioritising ESG Impact Over Risk – ESG Investor (https://www.esginvestor.net/asset-owners-prioritising-esg-impact-over-risk/)

5 Institutional Asset Owners Approaches to setting social and environmental goals (https://thegiin.org/assets/Institutional%20Asset%20Owners_Approaches%20to%20setting%20social%20and%20environmental%20goals.pdf)

6 Investing in a better world (https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/834207/Investing-in-a-better-wold-full-report.pdf)

7 For example see the GIIN’s guidance for pursuing impact in listed equities (https://thegiin.org/research/publication/listed-equities-working-group/)

8 ‘Impact. Reshaping capitalism to drive real change’, Sir Ronald Cohen, Ebury Press, 2020

9 The FCA’s proposed Sustainability Disclosure Requirements include a ‘sustainable impact’ label (https://www.fca.org.uk/publications/consultation-papers/cp22-20-sustainability-disclosure-requirements-sdr-investment-labels)

10 The European Securities and Markets Authority have set out their recommendations on what ‘impact’ and ‘impact investing’ should encompass (https://www.esma.europa.eu/sites/default/files/library/esma34-472-373_guidelines_on_funds_names.pdf)

11 Market sizing | Impact Investing Institute (https://www.impactinvest.org.uk/our-work/projects/market-sizing/)

12 While an individual investor’s ability to support a company’s share price is likely to be transitory, longer-term support comes from individual investors ‘crowding in’ support from the wider market. See ‘Guidance for pursuing impact in listed equities’, GIIN for more discussion on this topic.

13 In a White Paper WHEB sets out a system level view of impact investing in listed equities: https://www.whebgroup.com/news/whebs-new-white-paper-impact-investing-in-listed-equities

14 Snowball’s framework considers the positive impact that Snowball has, the impact that their asset managers have, and then the enterprise impact that investees deliver https://www.snowballimpactinvestment.com/insights/How%20we%20measure%20impact

15 Friends Provident Foundation is invested in Snowball. Friends Provident Foundation's Director is on the board of Snowball Impact Management Limited. Snowball invests in WHEB’s FP WHEB Sustainability fund.

16 Montanaro Better World Fund Impact report 2022. See page 8 https://montanaro.co.uk/wp-content/uploads/2022-Impact-Report-Montanaro-Better-Word-Fund.pdf

17 Theory of Change - Social Impact Foundation https://www.youtube.com/watch?v=cg4J1g0IVHg

18 https://www.thinknpc.org/resource-hub/thinking-big-how-to-use-theory-of-change-for-systems-change/

19 See reflections on the use of theory of change: https://frompoverty.oxfam.org.uk/theories-of-change-the-muddy-middle-and-what-to-do-about-assumptions/

20 Impact report 2019 | Triodos Investment Management (triodos-im.com)

21 See webinar on how Triodos implements theory of change for its financial inclusion priority: https://www.brighttalk.com/webcast/16997/361040

22 https://www.whebgroup.com/assets/files/uploads/wheb-impact-report-2022.pdf

23 https://www.johcm.com/siteuploads/news/Press%20release20Launch%20of%20Regnan%20Global%20Equity%20Impact%20Solutions%20Fund.pdf

24 https://eqinvestors.co.uk/wp-content/uploads/2021/10/Meeting-needs-in-emerging-markets-80%93-Positive-Impact-Report-2021-Launch-Webinar-2-80%93-Slides.pdf