You’d imagine that we would have got used to the relentless 24-hour news cycle. But the pace and importance of developments in 2022 has felt particularly unremitting. The war in Ukraine and the terrifying prospect of a nuclear exchange has dominated headlines all year. But extreme weather, and in the UK at least, unremitting political drama, have kept other significant, but less dramatic, developments out of the headlines.

One of these developments has been the challenge of accessing healthcare. In the UK nearly 7m people – one in eight of the population – is now waiting for NHS treatment. This news attracted headlines when it was announced in early September but was then rapidly overtaken by coverage of the death of the Queen and then latterly the antics of the new Conservative government.

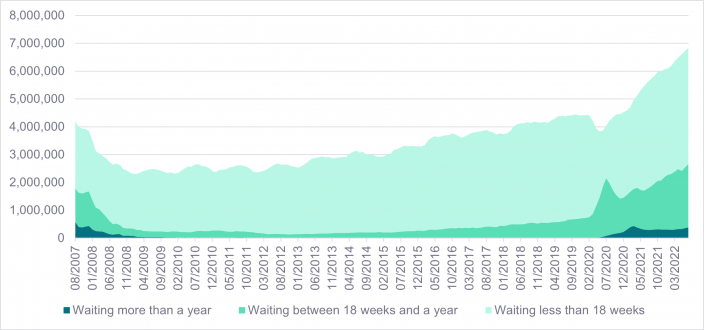

Figure 1: NHS waiting times for consultant-led elective care1

While wait times are typically less than 18 weeks for elective procedures (see figure 1), there are now nearly 400,000 patients who have been waiting over one year for treatment. Before the pandemic, the number of patients waiting for more than a year for treatment was ‘just’ 1,032 individuals.

Hospital beds and secondary care

While there has been a long-term trend in increasing wait times, it is clear from NHS data that there was a notable inflection during the COVID pandemic. This has also been evident in data from the US where 60% of hospitals still have some level of backlog to work through because of COVID-related constraints.2 However, in contrast to the UK, in the US over 90% of hospitals surveyed indicated that capacity constraints or disruptions from COVID cases were now either non-existent or relatively modest in nature and the remaining backlog is expected to be cleared quite quickly.3

Across the European Union, the picture is more mixed. Germany has a high capacity of hospital beds with nearly 8 beds per 1,000 inhabitants and has largely worked through its backlog of hospital procedures. The EU average is just over 4 beds per 1,000 inhabitants while the UK languishes on just 2.4 beds per 1,000.4

This low ratio of beds to inhabitants is seen as a key issue in addressing the backlog of secondary care procedures including both elective procedures and critical care that involves a hospital stay.

Primary care provision

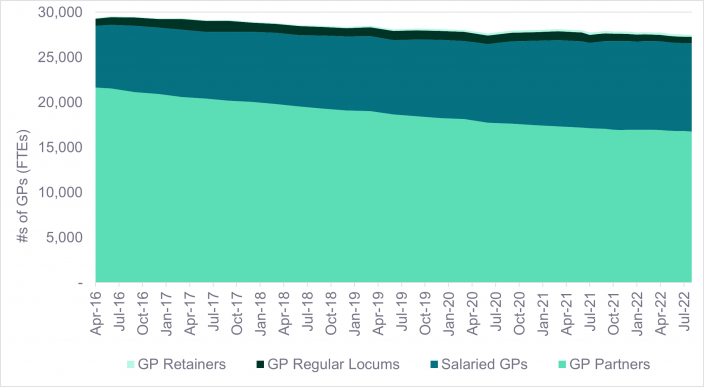

While we have seen growing waiting lists for secondary care, primary care through GP practices is also under-pressure. When waiting to speak to the receptionist at my local GP surgery, you are informed while on hold that the surgery is under-staffed and actively recruiting. This predicament is a chronic one affecting the whole of the country. GP numbers have been in long-term decline with no signs of this abating.

Figure 2: Numbers of qualified GPs in England5

The UK is not alone is suffering chronic shortages of medical staff. The US is in a similar predicament. In March of this year, the American Hospital Association wrote to the House Energy and Commerce Committee calling the workforce shortage hospitals were experiencing a ‘national emergency’ and projecting that the overall shortage of nurses would reach 1.1 million by the end of 2022.6 Like the UK, the US is also suffering from burn-out with large numbers of medical professionals thinking of leaving the field to pursue careers elsewhere. A February 2022 survey conducted by USA Today and Ipsos of more than 1,100 health care workers found nearly a quarter of respondents said they were likely to leave the field in the near future due to the pandemic.7

How WHEB investments help

The solutions to the healthcare backlog in these countries are of course complex and contested. More funding would clearly help, but there are also technological innovations that can help to reduce the pressures on healthcare systems.

Quicker and more accurate diagnostics

One area in which the WHEB strategy is heavily invested is in better diagnostics. This includes the deployment of diagnostic tools that can be used at point of care including both hospitals and potentially GP surgeries. Danaher’s Cepheid business for example provides point of care testing for influenza.8 bioMérieux has diagnostic tools for rapid (<4hrs) point of care testing for sepsis and meningitis – both conditions that require extremely urgent treatment.9 More accurate and quicker diagnosis reduces wait times for treatment and the length of hospital stays. In turn this helps reduce pressure on healthcare systems.

Therapies and medical devices

Another significant area targeted by the strategy is therapies and medica devices for treating ill-health. Some of these are more focused on innovative new therapies that deliver better health outcomes than they are on saving money, but others are clearly aimed at reducing the burden on the healthcare network. CSL’s Seqirus business for example is focused on developing flu vaccines – preventative care that keeps people healthy and out of hospital.10 Fisher & Paykel have a homecare business that is focused on developing devices that patients can use at home to manage obstructive sleep apnea.11

Adding capacity to healthcare services

The chronic shortage in healthcare staff is also an issue that the WHEB strategy has some role in addressing. Our single investment in our Education theme is in a US business called Grand Canyon Education. This company has a subsidiary, Orbis Education that helps expand the healthcare workforce.12 They do this by helping fund capital expansion projects by colleges and universities offering healthcare education, enabling online healthcare courses and connecting colleges with healthcare organisations to support placements and other on-the-job training.

Increasing the supply of trained healthcare professionals is unlikely however to meet all the projected increase in demand for healthcare services over the medium term. New more efficient ways of delivering healthcare will also have to play a part. The role of the private sector is particularly sensitive in this regard, especially in the UK. As a managed care organisation, Centene has been particularly focused on maximising the efficiency of healthcare service provision in the US. The company has for example supported the development of value-based healthcare as part of the Affordable Care Act. In the UK the company has sought to increase the role played by physician associates in primary healthcare as a way of maximising access while controlling costs. As we have reported previously, this has proven controversial. Nonetheless, healthcare delivery will clearly have to evolve if waiting lists and staff shortages are not to overwhelm it.

1 NHS waiting lists: https://ifs.org.uk/collections/nhs-waiting-lists

2 ‘Hospital Survey: Backlog’s healthy, electives firm up, staffing still a concern’, Jefferies Equity Resarch, April 2020

3 Ibid

4 https://www.bma.org.uk/advice-and-support/nhs-delivery-and-workforce/pressures/nhs-hospital-beds-data-analysis

5 https://digital.nhs.uk/data-and-information/publications/statistical/general-and-personal-medical-services

6 https://www.aha.org/lettercomment/2022-03-01-aha-provides-information-congress-re-challenges-facing-americas-health

7 https://www.ipsos.com/en-us/news-polls/usa-today-ipsos-healthcare-workers-covid19-poll-022222

8 https://www.cepheid.com/en/about

9 https://www.biofiredx.com/

10 https://www.seqirus.com/

11 https://www.fphcare.com/us/

12 https://orbiseducation.com/