#BudgeUpDave! Meet the future of the investment industry

#IAmAnAsset

Every year, hundreds of girls aged 13-18 participate in an investment competition run by Future Asset. In teams, they choose a company, then research and deliver a stock pitch.

It sounds pretty daunting, but the girls receive a ton of support from Future Asset and from their incredible teachers. Each team is also assigned a dedicated mentor from an asset management firm.

This year I was lucky enough to mentor two teams from Calderside Academy, in Glasgow. They chose to pitch animal health company Zoetis (because animals, obvs), and McDonalds (because, be honest, who doesn’t love a McDonalds?).

I really loved seeing the girls throw themselves into the competition. They were always full of great questions, fun ideas, and a healthy dash of debate!

I am incredibly proud of all of them. And I am especially impressed that the Money Makers team (pictured) took home the trophy! Congratulations!

Above: Sophie, Emma, Chloe, Anna, Mollie, and Millie from Calderside Academy, presenting to the panel of industry judges.

Why we need organisations like Future Asset

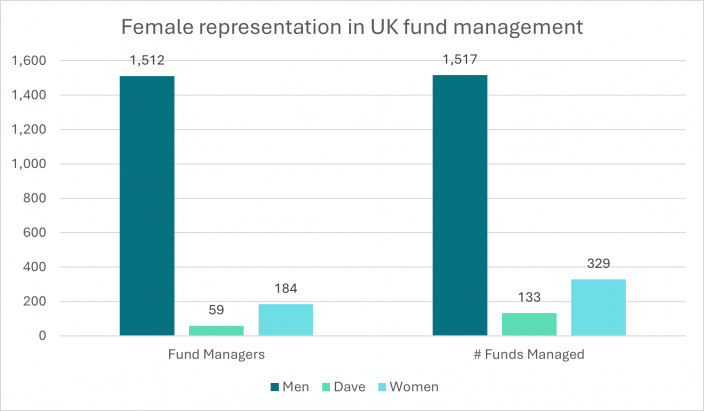

Future Asset’s slogan, #BudgeUpDave, is inspired by a 2019 article by Morningstar. Their research found there were more investment funds in the UK run by men named David than there were funds run by women1.

Wow.

A few years later, updated analysis means we can now thankfully say that women have surpassed Daves in the UK fund management industry (soz Dave).

But the data is no less depressing – 184 female fund managers to 1,512 males. In other words, women make up just 11% of UK fund managers2.

For comparison, a third of law firm partners are female3. Around 20% of senior accountants are female4.

This makes no sense.

I’ve seen first-hand how rewarding this job can be. The girls clearly loved the competition.

And I’m not surprised that Future Asset’s reach has spread across Scotland like wildfire (currently, Future Asset is solely focused on Scotland).

Above: The dots represent new Future Asset programmes within Scotland.

Female underrepresentation on Boards is a problem across all industries

As team Money Makers learned during their research on Zoetis, the company has a female CEO – Kristen Peck.

Sadly, Kristen is massively outnumbered among the CEOs of America’s largest companies. Only 8% of CEO positions in the S&P 500, a financial index, are held by women5.

The picture on Boards is slightly better – about a third of S&P 500 Board seats are held by women. This follows years of slow and steady progress.

Too slow, really. At the current pace, the gender ratio won’t reach parity for at least another decade.6 For CEOs, it may be much, much longer.

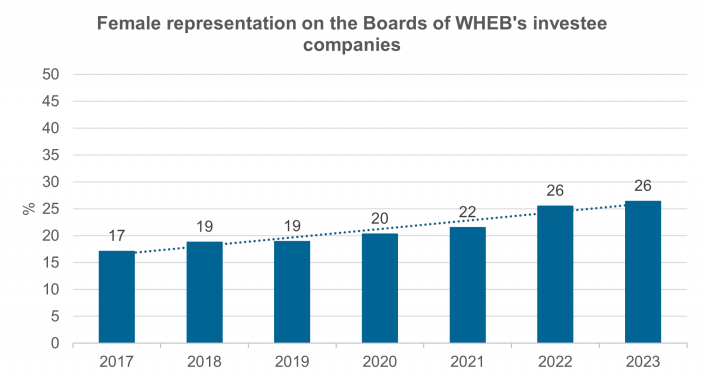

Gender and minority representation on Boards is something we at WHEB actively engage our investee companies on.

We, too, have seen slow and steady progress.

But we won’t stop until we reach a stage where our companies’ Boards more accurately reflect our society.

Some final thoughts

I am privileged to have worked with some extremely inspiring, creative, and intelligent women in my career. WHEB certainly has no shortage of them – we have more female employees than male. WHEB strives to create a culture that supports a diverse, equitable and inclusive workforce and this is something which is important to the whole team.

However, I am reminded of my ‘minority’ status every time I attend industry events.

I listen to tens of company earnings calls every quarter, sometimes without hearing a single female voice. Most often, if I do, it belongs to the person administrating the call.

Women are not a minority. We represent around half of the population.

I dread to imagine the experience of an actual minority. As just one example, one investment firm recently disclosed a 74% bonus pay gap for its black staff7.

As my colleague Sandhuni recently told IFA magazine, “Decisions taken by the financial industry can greatly impact the nation’s economy and individuals’ finances. It is important for financial services to reflect and celebrate our diverse society.”

We all have a lot of work to do.

No Davids were harmed in the writing of this article.

Sign up here to receive our monthly and quarterly commentaries in your inbox.

1 https://www.morningstar.co.uk/uk/news/197122/more-funds-run-by-daves-than-women.aspx

2 https://www.morningstar.co.uk/uk/news/219490/do-daves-still-outnumber-women-in-fund-management.aspx

3 https://www.ft.com/content/745499be-3ad6-4c9b-ab62-b8cc6830c315

4 https://financejourneys.com/women-in-accounting/

5 https://www.theceomagazine.com/business/management-leadership/countries-with-the-most-female-ceos/

6 https://news.bloomberglaw.com/daily-labor-report/womens-gains-on-s-p-500-boards-slow-delaying-parity-progress

7 https://citywire.com/wealth-manager/news/schroders-admits-74-bonus-pay-gap-for-its-black-staff/a2430502?utm_medium=website&utm_source=citywire_wm&utm_campaign=home-content-list-1&utm_content=wealth-manager-latest-news-list&utm_pos=1