2022 Impact report – The age of adoption

Titled ‘The age of adoption’, our latest impact report published in June is optimistic that the global economy is now well into the ‘S-curve’ of increasing deployment and market penetration of critical low and zero carbon technologies.

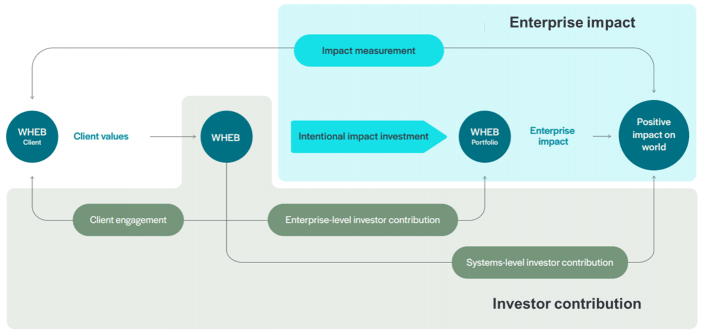

WHEB has made a bold claim to be a leading ‘impact investor’ investing in listed companies around the world. We base this claim on our model of what being an impact investor involves, shown in Figure 11. This model embraces two distinct, but complementary types of impact; ‘Enterprise impact’ and the ‘Investor contribution’. This approach is also increasingly reflected in the guidance and standards being developed by key groups like Global Impact Investing Network and the BSi to define best practice in impact investing2. We hope too that this model will also be evident in key public policy frameworks being developed in the UK and elsewhere.

Figure 1: WHEB’s model of impact investing

Enterprise impact – investing in companies that deliver positive social or environmental impact through their products and services

At the core of what it means to be an impact investor is the concept of ‘intentionality’. Specifically, when making an investment, the investor needs to intend for the investment to contribute to positive impact. At WHEB, for every investment we make, we set out the specific problem that we are trying to solve and the ‘theory of change’ that links the company’s products and services with positive change in addressing the stated problem. The impact report gives examples of how this operates in practice along with a detailed worked example of how the ‘impact engine’ is used to assess the impact of SolarEdge’s products3.

Measuring impact

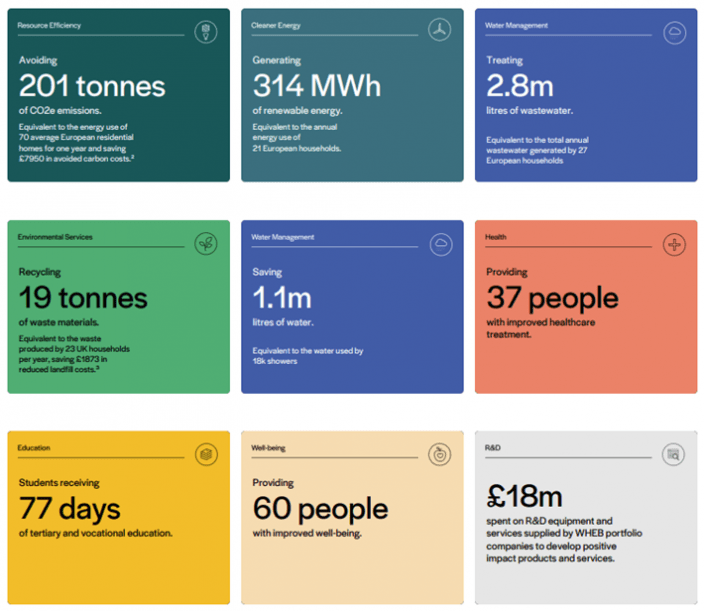

WHEB has for many years now pioneered the use of impact calculators as a way of measuring and reporting impact. This year, instead of collecting data from companies ourselves, and having it reviewed by a third party, we have instead used data from an independent third party. We anticipate that going forward our data will become more reliable - and comparable – with other impact managers as a consequence.

Figure 2 illustrates the positive impact associated with an investment of £1m in the FP WHEB Sustainability Fund. This year we have added an additional indicator that shows the amount of money that was used to buy research and development (R&D) equipment and services from WHEB portfolio companies. Although not a direct positive impact in itself, more and better R&D is critical in delivering improvement in healthcare and environmental outcomes. Our ambition next year is to expand our reporting on the negative impacts that are associated with the products and services sold by WHEB portfolio companies.

Figure 2: The impact associated with an investment of £1m in the FP WHEB Sustainability Fund in 2022

The investor contribution

Alongside the enterprise impact, to be fully-formed, impact investors should also set out how their own activities – as distinct from the activities of investee companies – help to ‘support, accelerate or enhance the ability of investee companies to deliver positive impacts’4.

WHEB does this in several ways including in the first instance through purchasing equity in the business using a long-term investment horizon. In addition though, WHEB also makes an investor contribution through our engagement with investee businesses. This engagement, along with the work we do with other stakeholders such as standard setters and regulators, is a core part of our investor contribution.

Delivering net zero carbon emissions

Alongside delivering products that help reduce greenhouse gas (GHG) emissions, one key area that we remain heavily engaged in is ensuring that WHEB portfolio businesses are also reducing their own operational GHG emissions. Having achieved our previous target three years early, at the end of 2022 we set a new target that, by 2025, 85% of our portfolio’s scope one and two emissions should covered by a net zero carbon (NZC) target of 2050 at the latest. And by 2030, 100% of the portfolio should be covered. At the end of 2022, 80% of portfolio emissions were covered.

Meanwhile, the status of actual GHG emission reductions is more mixed. In terms of the carbon footprint of the portfolio at the end of 2022, this was down 77% from 20195. This result is mainly the consequence of our selling a waste-to-energy operator in 2020.

We also measure the carbon footprint of investee companies that are held in the portfolio across the period. This number increased year on year and is now only down 3% on 2019. The main contributors to this increase were companies that increased their sales dramatically in 2022. This group included Genmab, SolarEdge and Advanced Drainage Systems. We expect that companies’ NZC commitments will begin to bear fruit in the years ahead and hope to bring the rate of GHG emission reductions back in-line with the overall targets that we have set. These are to deliver a 50% reduction in GHG emissions by 2030 and be fully net zero carbon by 2050.

Radical transparency

This latest impact report is our ninth. We were the first listed equity impact investor to produce an impact report and see this as part of our ambition to be radically transparent to clients and other stakeholders. We are proud of the work we have done to put positive impact at the core of our investments and of our portfolio. We want our investors to be excited about the investments that we have made on their behalf and so share publicly our full portfolio with detailed profiles on each holding. But we think that all impact investors should do this as a point of principle. Every investment in an impact portfolio should have a positive impact and a clear theory of change that backs it up.

After more than ten years of pushing boundaries on transparency, we think all impact investors - perhaps all investors – should be fully transparent about their portfolios. Not just transparent about the top ten largest holdings as is often the case, but everything in the portfolio.

We hope that the additional disclosures that we provide this year – including a stand-alone net zero carbon report and a stewardship and engagement brochure – are also helpful to clients. And whether it’s through more detailed carbon reporting, a clearer articulation of what being an impact investor is about or in publishing the minutes of our investment advisory committee meetings, we want to invite investors in and hopefully leave them excited and proud to be investors in our funds.

Sign up here to receive our monthly and quarterly commentaries in your inbox.

1 For a fuller description of the model please visit https://www.whebgroup.com/investing-for-impact/about-impact-investing/our-perspective

2 For example the GIIN’s guidance on impact investing in listed equities (https://thegiin.org/research/publication/listed-equities-working-group/)

3 https://www.whebgroup.com/assets/files/uploads/wheb-impact-report-2022-spreads.pdf?

4 Op cit 2

5 This is measured as ‘financed emissions’ which is calculated as the sum of each of the fund’s percentage ownership (including equity and debt) in each investee business multiplied by the investee’s scope one and two emissions.