WHEB is among 15 new signatories of the Finance for Biodiversity Pledge announced at COP15

126 signatories representing €18.8 trillion in assets and 21 countries

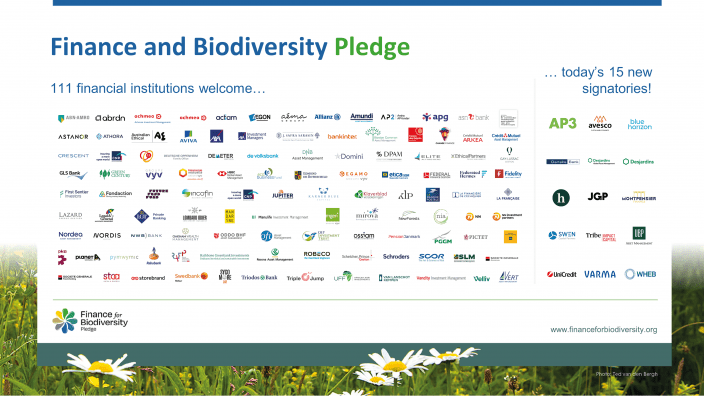

14 December 2022 – AP3, Avesco Sustainable Finance, Blue Horizon, Danske Bank A/S, Desjardins Global Asset Management, Desjardins Investments, Helios, JGP, Montpensier Finance, SWEN Capital Partners, Tribe Impact Capital, UBP Asset Management, UniCredit, Varma and WHEB Asset Management are the 15 new signatories of the Finance for Biodiversity Pledge. The new signatory financial institutions will be welcomed by Amanda Blanc, CEO of Aviva, during the Second Plenary of the ‘Finance and Biodiversity Day’ organised by the UN Convention on Biological Diversity (CBD) in Montréal, on 14 December 2022 during COP15.

Milestones: 126 signatories of the Pledge and 60 members of the Foundation

With the new total of signatory financial institutions, the Finance for Biodiversity Pledge is now representing a total of €18.8 trillion in assets, held by the 126 signatories from 21 countries. We have representation of a signatory from a new country, Brazil. Furthermore, the Finance for Biodiversity Foundation is reaching the milestone of 60 members collaborating and sharing knowledge on biodiversity.

Highlight: increasing the diversity of the community of signatories

On the occasion of COP15, a great diversity of financial institutions are joining the growing movement of financial institutions committed to protect and restore biodiversity. With the signatures of Helios, Danske Bank, and UniCredit, the Finance for Biodiversity Pledge now counts 15 private banks among the signatories. Helios is the first Fintech to join the community of Pledge signatories. UniCredit is the first member of the Finance for Biodiversity Foundation from Italy. JGP is the first signatory and member from Brazil.

Launching event during ‘Finance and Biodiversity Day’ at COP15

COP15 will include a dedicated full-day event on Finance and Biodiversity on 14 December, in Montréal, Canada. The Finance for Biodiversity Foundation is the co-organiser, together with the CBD secretariat and other partners. This will provide a unique opportunity for the global financial community to engage in discussions, share perspectives, and communicate on their actions, achievements and commitments related to the integration of biodiversity within financial decision-making

Finance for Biodiversity Pledge

The Finance for Biodiversity Pledge is a commitment of financial institutions to protect and restore biodiversity through their finance activities and investments. The Pledge consists of 5 steps financial institutions commit to take:

1. Collaborating and sharing knowledge

2. Engaging with companies

3. Assessing impact

4. Setting targets

5. Reporting publicly on the above before 2025

As financial institutions, they call on global leaders to agree on effective measures to reverse nature loss in this decade, during the Conference of the Parties (COP 15) to the Convention on Biological Diversity (CBD) taking place in Montréal, Canada from 7 to 19 December 2022.

Working groups

Financial institutions that have signed the Finance for Biodiversity Pledge can become members and join the working groups of the Finance for Biodiversity Foundation. With this new round of signatories, the total number of members increased from 56 to 60. The members are sharing knowledge and collaborating on topics such as impact assessment, engaging with companies, public policy advocacy, and target setting. An additional working group on positive impact will start next year.

New signatory round in Q1 2023

There will be another round of celebrating new signatories in Q1 2023. Financial institutions can already sign up via our registration page here.

Anita de Horde

Coordinator of the Finance for Biodiversity Foundation

+31 6 55 88 64 86

Natacha Boric

Communications and Community Coordinator

+33 6 64 22 63 83