The ESG ‘stampede’

The WHEB team has a fifteen-year track record in sustainable investing. Looking back over this period, we can say that this is undoubtedly the most exciting period in this history. We say this with the scars still-fresh from fighting what was, until very recently, a lonely battle. Many of our clients have also been on this journey and are now enjoying what we’ve been calling the ‘ESG stampede’.

You can see the evidence of this stampede in the share prices of strongly thematic companies. Ty Lee commented on this in the October monthly update. He pointed to the share price performance of companies like ITM Power and Ballard Power1. These companies are thought to be strong beneficiaries of the growth in green hydrogen. There are similar patterns in the share price performance of other companies involved in, for example, alternative meat and plant-based protein food product. Excitement is in part driven by the much lower carbon footprint that these products offer compared to traditional meat products.

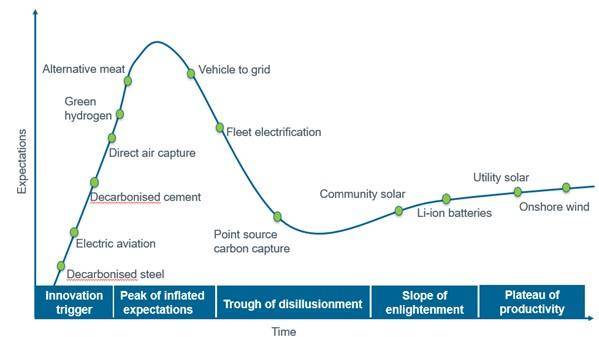

The companies behind these and other sustainability-oriented products represent extremely exciting opportunities to reduce greenhouse gas (GHG) emissions. They also represent high risk investment propositions. The majority of these businesses operate in intensely competitive markets. Most are also heavily loss-making and are likely to remain so for many years. Green hydrogen and alternative meat technologies are still at an early stage in their development. The current exuberance is, in our view, likely to evaporate as the timescales for real change become clear. The familiar ‘Gartner hype cycle’ is, we believe, still apposite in this context.

“Quality will out”

At WHEB we believe there is a better and lower risk approach to accessing some of these breakthrough developments. Our focus is in finding companies that have existing established franchises with a solid positive impact story. Companies where the core product has matured and provides a predictable return profile. These are companies that have already gone through the ‘hype cycle’.

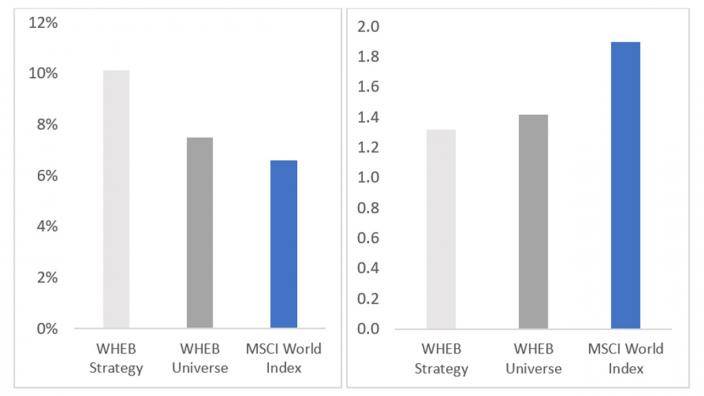

The WHEB portfolio is characterized by companies that have strong cash-flow returns and relatively low levels of leverage (see figures 2). They are also adept at managing the environmental and social footprints of their operations and have strong governance structures. They are, in short, high quality businesses. But on top of this, and perhaps even more importantly, we seek to find businesses that have vision and ambition. These are companies that have a strong quality foundation and energetically pursue and invest in breakthrough applications alongside their core business.

Three companies in the portfolio that exhibit many of these characteristics are listed below. Each of these has an existing franchise with a strong competitive position and established products. At the same time, they are building new high impact franchises in adjacent markets.

Renishaw and the treatment of Parkinson’s Disease

Renishaw, the UK engineering champion, displays many of these characteristics. It’s a world leader in industrial metrology equipment. Renishaw has a long track record in probes and gauging systems which improve quality and reduce wastage in manufacturing operations around the world. Using their knowledge in precision measurement, the company has also developed a novel system to treat sufferers of Parkinson’s disease. This system is still undergoing clinical trials and involves very precise delivery of drugs into the patient’s brain. With ten million sufferers today, this product has the potential to revolutionise treatment of this disease.

Tackling greenhouse gas emissions in agriculture

DSM is a Dutch specialty chemical business with a specific focus on sustainability and nutrition. Alongside their core business in human and animal nutrition, DSM is developing several breakthrough products. One of these is called Bovaer and is a feed additive for ruminants and particularly dairy cows. Livestock as a whole are responsible for 14.5% of total global greenhouse gas emissions. The vast majority of this comes from cows – specifically cows burping. Bovaer works by suppressing the enzyme that triggers methane production in a cow’s rumen. It reduces enteric methane emissions by approximately 30%. It takes effect immediately and it’s safely broken down in the cow’s normal digestive system. Following 30 on-farm trials and more than 25 peer-reviewed studies the product is due to launch in Europe in 2021.

Industrial gas giant positioning for the hydrogen economy

Linde is one of the giants of the industrial gases industry, whose products are used to reduce pollutants or improve efficiencies in many downstream industries. The company currently produces hydrogen from natural gas which is used to desulphurise fuels to reduce air pollution.

Hydrogen is also emerging as a potential solution in decarbonising steel-making, heating in buildings and heavy goods transport. In order to play this role, the carbon emissions from hydrogen production need to be eliminated. This can be done either through capturing the carbon and storing it underground (‘blue’ hydrogen) or by producing hydrogen from electrolysers which do not produce carbon dioxide emissions (‘green’ hydrogen).

Neither of these technologies is currently competitive but Linde is bringing its knowledge of handling hydrogen to reduce costs in its manufacture, distribution and use. It is currently involved in over one hundred projects ranging from pilot projects with electrolysers through to the storage and distribution of hydrogen for fuel cell vehicles. The market is still tiny in comparison to the rest of Linde’s business. With anticipated cost reductions, the market is expected to grow by fifty to one hundred times in the next ten years.

1 https://www.whebgroup.com/is-it-time-to-jump-on-the-hydrogen-bandwagon/#_ftn1

2 https://www.gartner.com/en/research/methodologies/gartner-hype-cycle adapted by Energy Impact Partners and WHEB.

3 WHEB/FactSet data as of September 2020

4 Ibid