“If you think education is expensive, try ignorance.”1

Education has always been one of WHEB’s nine investment themes. George Lucas, the filmmaker, called education ‘the single most important job of the human race’. It is central to the improvement of the human condition and as such, sits at the heart of the concept of sustainable development.

The subject of education is, however, rarely far from the centre of public debate. As the parent of a sixteen-year-old, who recently went through the trauma of not sitting her GCSEs, it certainly feels like 2020 has had more than its fair share of education-related headlines.

The UK Prime Minister turned his attention to education at the end of September. In a speech at a further education college, he highlighted the critical role that education will play in helping to re-build the UK’s economy following the COVID-19 pandemic. Boris Johnson argued that the pandemic is “massively accelerating” changes in the economy. In response the UK Government will offer a new “lifetime skills guarantee” to help adults without A-levels acquire new skills. Skills that he believes will be needed “as old types of employment fall away, and new opportunities open up with dizzying speed”.2

COVID-19, young people and education

As the COVID-19 pandemic has played out it has also become clear that young people, and particularly those in the 18-25 age group, have been disproportionately affected. In the UK, half of the eligible unemployed who were put on furlough were under 25-year-olds. Unemployment among 16-24-year olds is now over 13% compared with just 4% across the UK as a whole3. These statistics are broadly replicated across much of Europe and North America.

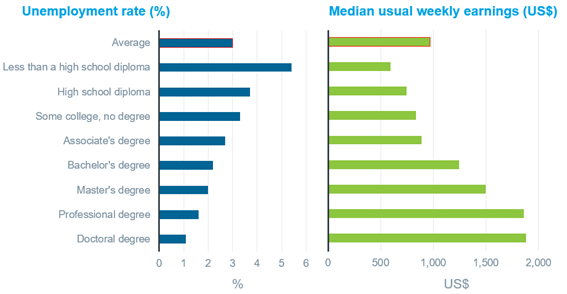

With such dismal prospects in the job market, many school-leavers are expected to enrol in higher education. Recessions tend to mean that people want more education because the alternatives of underemployment or unemployment are even worse. The UK’s Office for Budget Responsibility for example has increased its forecasts for new English-domiciled students by over 100,000 over the next three years4. The evidence indicates that this is a sensible strategy for these young adults. A 2019 study by the US Bureau of Labor Statistics confirmed the pattern found in previous studies. Unemployment rates are indisputably and significantly lower and median weekly earnings substantially higher at every level of higher educational attainment.

Investing in education

WHEB’s Education theme has always been one of the smaller themes within the WHEB portfolio. In fact, for three years between September 2013 and November 2016 the strategy had no exposure at all to education. Up until that point, we had been invested in the UK academic publisher Pearson plc. However, we had become increasingly concerned at that time about major changes in the education market caused by the advent of digital publishing and on-line study.

While that concern turned out to be prescient, it was the same changes wrought by the impact of on-line education that drew us back into the Education theme. In November 2016 we started a position in the US tertiary education provider Grand Canyon Education. This private university, located in Phoenix Arizona, had built a highly successful online education business. In fact, in terms of participating students, the on-line business was more than three times as large as the campus-based student body.

In 2020 we also started a position in Strategic Education. We mentioned this business in last quarter’s report because they have a particular focus on students who did not have the opportunity or financial means to continue their education after high-school. The majority of students are working adults who are returning to education in order to improve their career opportunities. 76% of students are female and 64% are people of colour. Strategic Education has for some time also supplied predominantly on-line education. Since the advent of the COVID-19, their entire curriculum has moved on-line.

Education and politics

In spite of the challenges generated by COVID-19, we believe that both of these businesses will emerge stronger as a consequence of the pandemic. Not just because we expect enrolment to increase, but because both have already established strong on-line education platforms; assets that are likely to be of particular importance in the months and years ahead.

Nonetheless, both stocks have underperformed quite dramatically in the past few months. Strategic Education is seeking to make a significant acquisition of an Australian private university. This has caused some investors to worry that the business may be over-extending – and overpaying – for this. We are confident that the acquisition makes strategic sense and remain supportive.

In addition, as private-sector businesses, both companies are typically seen as ‘Republican’ stocks as Republicans have tended to take a more supportive view of private sector involvement in education. Democrats in contrast have tended to be more sceptical about private sector education provision. Both stocks have sold-off as the prospects have improved of a Democratic victory in the US Presidential election.

On this point too, we remain sanguine. There have unquestionably been some very irresponsible and poor-quality educational qualifications. A certain ‘Trump University’ springs immediately to mind. This was the subject of an inquiry by the New York Attorney General’s office for illegal business practices and two class-action lawsuits. In contrast though, Grand Canyon University has not increased their fees for their campus-based education for 12 years and, along with Strategic Education, have consistently achieved high scores for the quality of their education. Cohort default rates for both institutions are well below 15% and performance levels against the Gainful Employment rule are well ahead of those prescribed by the US Department of Education6.

COVID-19 is clearly changing the world of work very quickly. New skills derived from a good quality education are clearly ever more important. As the headline of this article makes clear, education can be expensive, but it is a lot cheaper than ignorance.

1 Quote attributed to Derek Bok, President of Harvard University 1971-1991

3 https://www.timeshighereducation.com/opinion/covid-19-could-be-curse-graduates-boon-universities

4 http://obr.uk/efo/economic-and-fiscal-outlook-march-2020

5 Source: US Bureau of Labor Statistics, Current Population Survey (2019) https://www.bls.gov/emp/chart-unemployment-earnings-education.htm

6 The US Government sets performance thresholds for educational establishments in order to qualify for federal funding. The ‘Cohort Default Rate’ is the percentage of a school’s borrowers who enter repayment on certain loans during a federal fiscal year and default prior to the end of the next one to two fiscal years. The ‘Gainful Employment Rule’ requires schools to provide their students with an education adequate enough for them to pay their college loans back so that they will be gainfully employed after they graduate from college.