Last week the Intergovernmental Panel on Climate Change (IPCC) published the latest report from its first Working Group.1 There are three Working Groups and Working Group 1 focuses on the physical science of climate change, while the other two look at adaptation and mitigation. So this report gives us the state of play on the science itself.

Even by the standards of climate change news, it made for sobering reading.

The main takeaway is the now-irrefutable link between human activity, global warming and extreme climate events. The data is overwhelming, both in volume and severity. Some of the damage may not be reversed within centuries, or even millennia, even if the climate is stabilized soon. Under the most optimistic scenario the Earth’s surface temperature will continue to increase until at least 2050. The warnings are stark.

Setting targets

Yet, as campaigners like Greta Thunberg have pointed out, the report doesn’t tell us what to do. The IPCC doesn’t set policy; it just provides the evidence for doing so. A pretty good fixed point now is that global greenhouse gas (GHG) emissions need to be at net-zero before 2050.

We all have a role in solving the problem, and that includes investors. WHEB is a founding member of the Net Zero Asset Managers initiative and we are engaging extensively with our portfolio of companies.

With over a third of the portfolio now having a net zero target, we are relatively pleased with progress so far. But this report makes it clear that targets won’t be enough: we need to be looking at results. Rapid and sustained cuts are needed. Carbon neutrality isn’t a balancing exercise in the accounts. Addressing the challenge requires wholesale transformation of business models and economies. Investors need to understand where companies fit in that transition.

So take, for example, our investee company JB Hunt. Their core business is intermodal transport, which is 250% more fuel efficient than shipments by road.2 The company has published a Climate Action Plan which evaluates the costs of more aggressive emissions targets and identifies multiple potential reduction initiatives. The Plan also addresses the challenges associated with influencing GHG emissions from elsewhere in their value chain (‘scope 3’ emissions). This is essential for JB Hunt to commit to science-based GHG reduction targets.

It’s encouraging to see these strategic factors considered in detail, but like many others, the company still focuses on relative energy intensity when it is clear from the IPCC report that absolute reductions are needed. And they are wary of committing to a net zero target, while they are reliant on truck and train manufacturers to produce zero-emissions technologies. Overcoming this hesitancy is an important area for us to engage on with management.

Establishing carbon prices

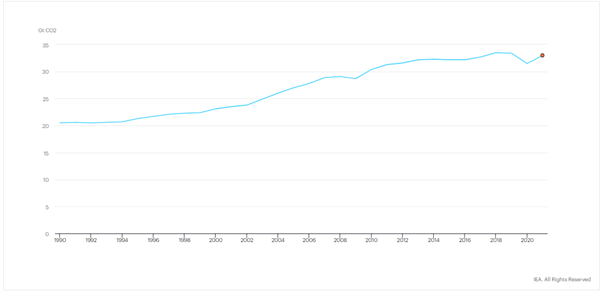

The report also makes clear that there is a global carbon budget if global warming is to be kept to less than 1.5°C. This stands at approximately 500bn tonnes of CO2.3 At the 2020 rate of emissions the budget will be exhausted in approximately 11 years.4 If emissions rebound in 2021 as expected, we will have even less time. Framing emissions as a finite resource should help investors think about the cost when companies spend that budget. It also allows us to challenge companies on their own cost assumptions.

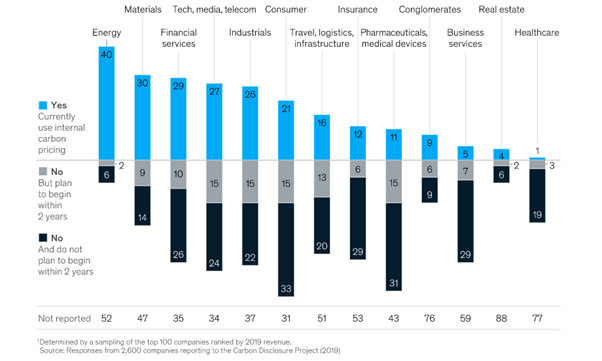

Wood Mackenzie estimated that carbon prices will need to reach $160 per tonne of CO2 by 2030. The global average at the end of 2020 was $22/tCO2.5 There is growing interest in internal carbon pricing but the practice is not widespread and like the market prices, internal carbon prices are still too low. In Europe, the median internal charge is $27/tCO26 – lower than the current market price in the EU Emissions Trading Scheme. We need to encourage companies to reframe their ambitions.

Efficiency is still important

The report also lends support to the role of efficiency and consumption pattern changes. It’s clear that on their own they cannot solve the problem, the pace of reduction required is too high. The UN Environment Programme estimated that global GHG emissions need to fall by approximately 8% per annum by 2030 to stay on track for 1.5°C. To put that target in context, in 2020, a year when the world stood still, emissions fell 5.8%.

It’s clear that the urgency is increasing, and incremental gains from efficiency need to be ramped up fast. Reducing emissions now means we spend less of the carbon budget, which means we have longer before we’ve exhausted it. That’s important in avoiding “tipping points”: thresholds where a small change can push a system into a completely new state.9

Extending how long our budget will last is essential. As well as in avoiding negative impacts, it also buys time to invest in new technologies. A key part of that will be the ability to take CO2 out of the atmosphere at scale. It is impossible to envisage warming of less than 1.5 degree without carbon dioxide removal.10

We also need to think about adaptation. In all scenarios climate change still has significant negative effects. Flooding has been particularly prominent in the headlines recently. One of our holdings, Xylem, provides technologies that help communities predict and adapt to the now inevitable impacts of damage from flooding. They are also investing in digital solutions and smart infrastructure solutions to improve resilience to water-related emergencies.11

Time for action

The IPCC report provides a frame of reference for investors to think about the scale of the climate challenge and provides evidence to support conversations with companies. It leaves no room for scepticism or inaction. Investors can use the report to create momentum behind initiatives like Net Zero Asset Managers. We can also encourage companies to take bigger steps towards detailed transition strategies. Most importantly, we need to increase accountability for results, not targets.

1 AR6 Climate Change 2021: The Physical Science Basis, https://www.ipcc.ch/report/ar6/wg1/

2 JB Hunt (2020), Climate Action Plan, https://www.jbhunt.com/content/dam/jbhunt/jbh/pr/press-releases/J.B.%20Hunt%20Climate%20Action%20Plan.pdf

3 Op. cit. 1

4 Carbon Brief (2021), In-depth Q&A: The IPCC’s sixth assessment report on climate science | Carbon Brief

5 Wood Mackenzie (2021), Significant increase in carbon pricing is key in 1.5-degree world | Wood Mackenzie

6 McKinsey (2020), The State of Internal Carbon Pricing, https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/the-state-of-internal-carbon-pricing

7 McKinsey, 2021

8 IEA (2021), Global energy-related CO2 emissions, 1990-2021 – Charts – Data & Statistics – IEA

9 Carbon Brief (2020), Explainer: Nine ‘tipping points’ that could be triggered by climate change | Carbon Brief

10 McKinsey (2020), How global business could mitigate climate change | McKinsey

11 Xylem (2020), Sustainability Report, https://www.xylem.com/siteassets/sustainability/2020/xylem-sustainability-report-2020.pdf